Budget Manager Job Description:

Budget managers are in charge of an organization’s finances and make sure that budgets are used in the right way. They develop and monitor budgets, analyze financial data, and provide recommendations to stakeholders. Budget managers typically work in finance or accounting departments and report to senior executives.

Most of the time, a bachelor’s degree in finance, accounting, or a related field is needed to become a budget manager. Certified Public Accountant (CPA) or Certified Management Accountant (CMA) professional certifications are also preferred.

Budget Manager Responsibilities:

Budget managers have several responsibilities, including:

- Budget Creation and Monitoring: Budget managers are responsible for creating a budget that meets the needs of an organization while also aligning with its financial goals. They work closely with department heads and other stakeholders to understand their financial needs and create a budget that meets those needs while staying within the organization’s financial goals. Once the budget is created, they monitor its progress and make adjustments as needed.

- Financial Analysis and Forecasting: Budget managers conduct financial analysis and forecasting to identify potential issues and opportunities. They analyze complex financial data and make suggestions to stakeholders like senior executives, department heads, and investors.

- Expense Management and Cost Reduction: Budget managers work to identify areas where costs can be reduced without sacrificing quality or efficiency. This can include negotiating contracts, identifying operational inefficiencies, and implementing cost-saving measures.

- Communication with Stakeholders: Budget managers regularly communicate financial information to stakeholders at all levels of the organization. They work to ensure that all stakeholders understand the budget and the organization’s financial goals.

- Team Management and Leadership: Budget managers may also be responsible for leading a team of financial professionals. They ensure that their team is meeting their goals and deadlines while also mentoring and developing their team members.

Budget Manager Requirements and Skills:

To become a successful budget manager, several requirements and skills are essential, including:

- Educational Requirements: A bachelor’s degree in finance, accounting, or a related field is typically required for this role.

- Professional Certifications: Professional certifications such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA) are also preferred.

- Technical Skills: Proficiency in financial software and data analysis tools is also essential.

- Analytical and Problem-Solving Skills: Budget managers must analyze complex financial data and make recommendations based on that analysis.

- Communication and Interpersonal Skills: Budget managers regularly interact with stakeholders at all levels of the organization, making communication and interpersonal skills crucial to their success.

To be a successful budget manager, a person needs to have the right skills and qualifications, such as a bachelor’s degree in finance or accounting, professional certifications, technical skills, analytical and problem-solving skills, and communication and interpersonal skills.

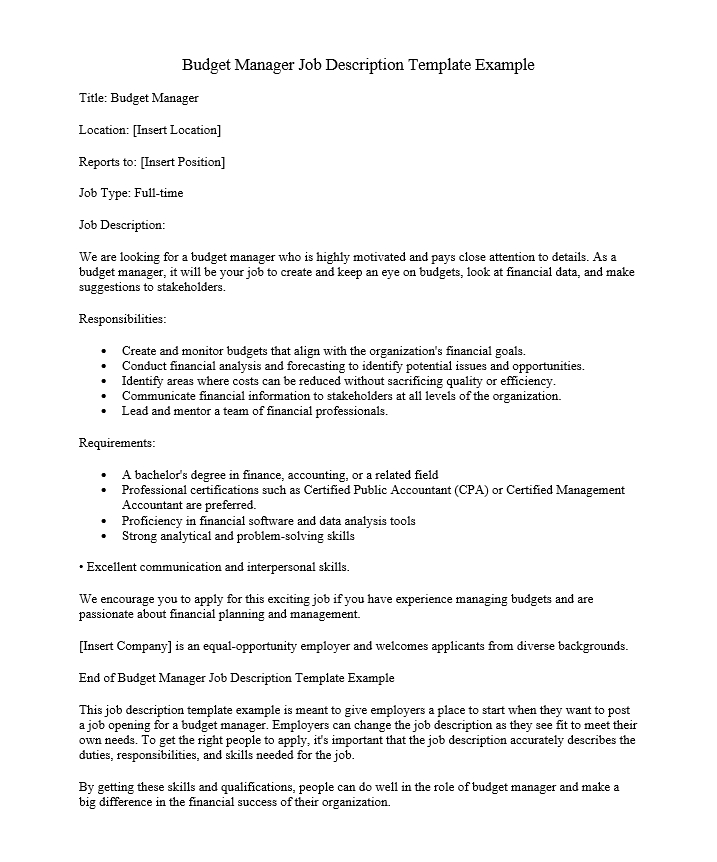

Budget Manager Job Description Template Example

Title: Budget Manager

Location: [Insert Location]

Reports to: [Insert Position]

Job Type: Full-time

Job Description:

We are looking for a budget manager who is highly motivated and pays close attention to details. As a budget manager, it will be your job to create and keep an eye on budgets, look at financial data, and make suggestions to stakeholders.

Responsibilities:

- Create and monitor budgets that align with the organization’s financial goals.

- Conduct financial analysis and forecasting to identify potential issues and opportunities.

- Identify areas where costs can be reduced without sacrificing quality or efficiency.

- Communicate financial information to stakeholders at all levels of the organization.

- Lead and mentor a team of financial professionals.

Requirements:

- A bachelor’s degree in finance, accounting, or a related field

- Professional certifications such as Certified Public Accountant (CPA) or Certified Management Accountant are preferred.

- Proficiency in financial software and data analysis tools

- Strong analytical and problem-solving skills

• Excellent communication and interpersonal skills.

We encourage you to apply for this exciting job if you have experience managing budgets and are passionate about financial planning and management.

[Insert Company] is an equal-opportunity employer and welcomes applicants from diverse backgrounds.

End of Budget Manager Job Description Template Example

This job description template example is meant to give employers a place to start when they want to post a job opening for a budget manager. Employers can change the job description as they see fit to meet their own needs. To get the right people to apply, it’s important that the job description accurately describes the duties, responsibilities, and skills needed for the job.

By getting these skills and qualifications, people can do well in the role of budget manager and make a big difference in the financial success of their organization.

Q: What is a budget manager?

A: A budget manager is responsible for overseeing an organization’s finances, including creating and monitoring budgets, conducting financial analysis, and providing recommendations to stakeholders.

Q: What are the key responsibilities of a budget manager?

A: Some of the most important things a budget manager does are make and keep track of budgets, do financial analysis and forecasting, look for ways to cut costs, share financial information with stakeholders, and lead and guide a team of financial professionals.

Q: What qualifications are needed to become a budget manager?

A: To become a budget manager, you usually need a bachelor’s degree in finance, accounting, or a related field. Certified Public Accountant (CPA) or Certified Management Accountant (CMA) certifications are preferred. It is also important to know how to use financial software and data analysis tools, as well as to have strong analytical and problem-solving skills.

Q: What qualities are important for a successful budget manager?

A: A good budget manager should have good communication and people skills, pay close attention to details, be good at analyzing and solving problems, and be able to work well as part of a team.

Q: What is the career outlook for budget managers?

A: According to the U.S. Bureau of Labor Statistics, employment of budget analysts, which includes budget managers, is projected to grow 5 percent from 2020 to 2030, about as fast as the average for all occupations. This growth is expected because government budgets are getting more complicated and organizations need to make smart choices about their money.

Q: What is the salary range for budget managers?

The range of salaries for budget managers depends on things like where they work, what industry they work in, and how much experience they have. According to Glassdoor, the national average salary for a budget manager in the United States is approximately $85,000 per year.

Q: What industries employ budget managers?

Budget managers can work in many different fields, such as the government, healthcare, education, non-profits, and the private sector.

End of FAQ: Budget Manager Job

Note: The goal of this FAQ is to give you general information about what a budget manager does. Specific job requirements and qualifications may vary depending on the organization and industry. Before applying for a job as a budget manager, you should do a lot of research and make sure you know what is expected of you.