Chartered Accountant Job Description

As a chartered accountant, your main job is to manage and analyze financial data in order to make suggestions for clients. You have to make sure that the financial records of your clients are correct and follow the rules. In this job, it’s important to pay close attention to the details to avoid making mistakes that could cost money.

Overview of Tasks and Responsibilities

Your tasks and responsibilities as a Chartered Accountant include:

Maintaining Financial Records

You are responsible for maintaining accurate financial records for your clients. This involves tracking all financial transactions, reconciling accounts, and updating financial statements regularly.

Preparing Financial Statements

You have to make financial statements for your clients, such as balance sheets, statements of income and expenses, and statements of cash flow. These statements give your clients an idea of how their businesses are doing financially and help them make decisions.

Advising Clients on Financial Matters

You provide financial advice to clients, including investment opportunities and cost-saving measures. You look at financial data to find trends, opportunities, and risks, and then you make suggestions that are in line with the business goals of your clients.

Auditing Financial Statements

You audit financial statements to ensure accuracy and compliance with financial regulations. This means going through all of the financial records, looking for mistakes or discrepancies, and fixing them.

Ensuring Compliance with Financial Regulations

You ensure that your clients comply with financial regulations and guidelines. This means keeping up with changes to financial regulations, advising clients on compliance needs, and putting in place the right controls to avoid fines or legal action.

Importance of Attention to Detail

Attention to detail is critical in the work of a chartered accountant. You have to be very careful when keeping financial records, making financial statements, and doing audits to avoid making mistakes that could cost you money or get you into trouble with the law.

Chartered Accountant Requirements and Skills

To become a chartered accountant, you must meet certain educational and professional requirements and have certain skills.

Educational Requirements

You must have a bachelor’s degree in accounting or finance, and some employers may require a Master’s degree in accounting or business. You must also pass the Chartered Accountant exam to obtain certification.

Professional Qualifications

A Chartered Accountant certification is required to practice in this field. You must pass the Chartered Accountant exam, which tests your knowledge of accounting principles, financial rules, and professional ethics.

Technical Skills

You must have a strong understanding of accounting principles, financial regulations, and accounting software. To manage financial data, you must know how to use spreadsheets and tools for financial analysis.

Analytical Skills

You must be able to look at financial data, find patterns and trends, and make suggestions based on what you find. You must be good at solving problems and be able to make decisions based on what you find out.

Communication Skills

You must be able to give clients clear and concise information about their money. You must be able to explain complex financial concepts to clients who may not have a financial background.

Attention to Detail

You must have excellent attention to detail.

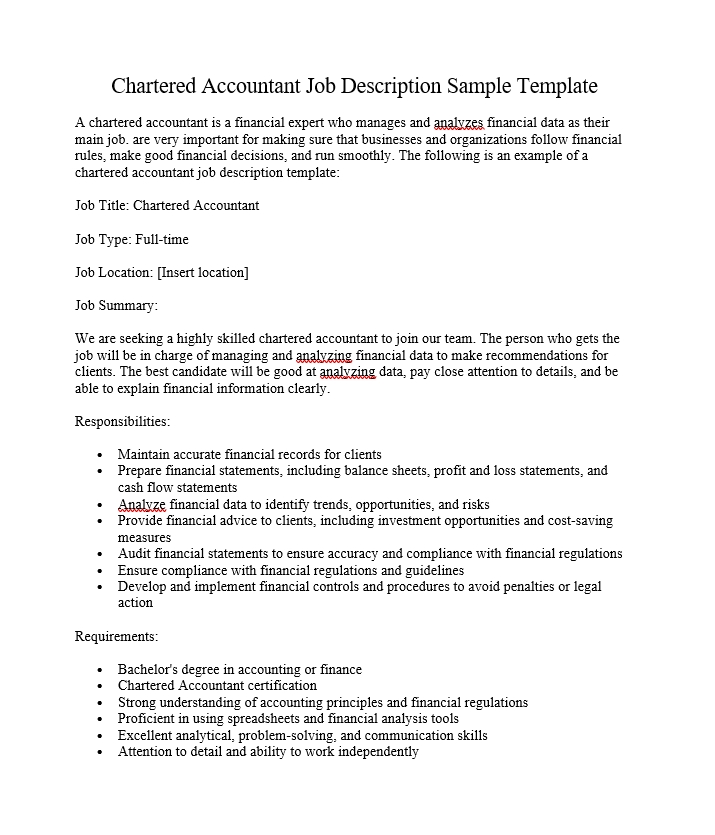

Chartered Accountant Job Description Sample Template

A chartered accountant is a financial expert who manages and analyzes financial data as their main job. are very important for making sure that businesses and organizations follow financial rules, make good financial decisions, and run smoothly. The following is an example of a chartered accountant job description template:

Job Title: Chartered Accountant

Job Type: Full-time

Job Location: [Insert location]

Job Summary:

We are seeking a highly skilled chartered accountant to join our team. The person who gets the job will be in charge of managing and analyzing financial data to make recommendations for clients. The best candidate will be good at analyzing data, pay close attention to details, and being able to explain financial information clearly.

Responsibilities:

- Maintain accurate financial records for clients

- Prepare financial statements, including balance sheets, profit and loss statements, and cash flow statements

- Analyze financial data to identify trends, opportunities, and risks

- Provide financial advice to clients, including investment opportunities and cost-saving measures

- Audit financial statements to ensure accuracy and compliance with financial regulations

- Ensure compliance with financial regulations and guidelines

- Develop and implement financial controls and procedures to avoid penalties or legal action

Requirements:

- Bachelor’s degree in accounting or finance

- Chartered Accountant certification

- Strong understanding of accounting principles and financial regulations

- Proficient in using spreadsheets and financial analysis tools

- Excellent analytical, problem-solving, and communication skills

- Attention to detail and ability to work independently

Q: What does a Chartered Accountant do?

A: Chartered Accountants are responsible for managing financial data, analyzing it, and obtaining a Chartered Accountant certification. You should also know a lot about accounting and financial rules, be good at using spreadsheets and other tools for financial analysis, and have strong analytical, problem-solving, and communication skills.

Q: What skills do I need to be a successful Chartered Accountant?

A: To be a successful chartered accountant, you need to have good analytical skills, pay attention to details, have good communication skills, be able to work on your own and know how to use spreadsheets and other tools for financial analysis. You should also possess knowledge of accounting principles and financial regulations.

Q: What is the career outlook for Chartered Accountants?

A: The career outlook for Chartered Accountants is positive, as businesses and organizations require financial professionals to manage their finances and ensure compliance with financial regulations. The demand for Chartered Accountants is expected to grow as businesses continue to expand globally.

Q: What are the benefits of becoming a Chartered Accountant?

A: Becoming a Chartered Accountant offers a range of benefits, including a competitive salary, career advancement opportunities, job security, and the opportunity to work in various industries. Chartered Accountants also play a critical role in shaping the financial success of businesses and organizations.