Overview of Comptroller Job Description

The comptroller’s job is to give advice to management on financial strategy, manage the organization’s money, and make sure that all laws and rules are followed.

Key Roles of a Comptroller

- The comptroller is the chief financial officer and is accountable for managing the organization’s day-to-day financial operations, maintaining accurate and complete financial records, and supervising the department’s accounting and auditing procedures.

- The comptroller is responsible for creating and overseeing the company’s budgeting and forecasting process, comparing actual financial results to projections, and highlighting any discrepancies or opportunities for growth.

- Internal Controls and Compliance: The comptroller develops and implements internal controls to ensure compliance with laws and regulations, monitors compliance with internal controls, and ensures the accuracy and completeness of financial reporting.

- Reporting and Analysis: The comptroller prepares and analyzes financial reports and statements, provides financial analysis to the management, and develops and implements financial models and tools to support decision-making.

Job Responsibilities of a Comptroller

The specific tasks a comptroller has to do may change depending on the company and industry. However, there are some responsibilities that we all share:

- Oversee the financial operations of the organization

- Ensure compliance with laws and regulations

- Develop and implement financial policies and procedures

- Plan, compile and evaluate budgets

- Provide strategic financial guidance to management

- Manage the budgeting and forecasting process

- Achieve timely and precise accounting records.

- Monitor cash flow and investment activities

Comptroller Responsibilities

Financial Management

It is the responsibility of the comptroller to oversee the organization’s day-to-day financial activities. The chief financial officer (CFO) of a company is accountable for maintaining accurate and up-to-date financial records.

Budgeting and Forecasting

The comptroller comes up with and manages the organization’s budgeting and forecasting process. He or she also keeps an eye on and analyzes the organization’s financial performance compared to the budget, finds places where things could be better, and makes suggestions.

Internal Controls and Compliance

The comptroller comes up with and puts in place internal controls to make sure that laws and rules are followed. Internal controls and the reliability and completeness of financial reporting are also checked for.

Reporting and Analysis

The comptroller makes and looks over financial reports and statements, gives management financial analysis, and creates and uses financial models and tools to help make decisions.

Comptroller Requirements and Skills

Educational Requirements

Most of the time, you need a bachelor’s degree in accounting, finance, or a related field to become a comptroller. A master’s degree in business administration (MBA) or accounting is preferred.

Professional Experience

Comptroller positions typically require 7-10 years of relevant work experience in accounting or finance. Prior experience in a managerial or supervisory capacity is also highly desirable. Experience in budgeting, forecasting, and financial analysis is highly desirable.

Technical Skills

A comptroller’s skill set would benefit from an understanding of financial and accounting concepts. An understanding of financial applications and infrastructure is crucial. Strong analytical and problem-solving skills are essential. Proficiency in Microsoft Excel and other financial software is also necessary.

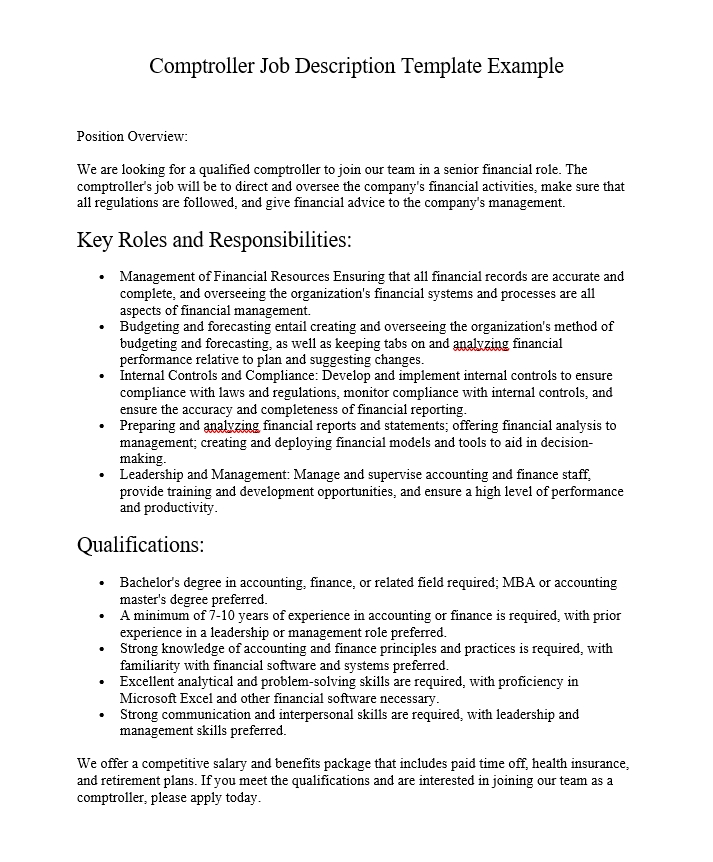

Comptroller Job Description Template Example

Position Overview:

We are looking for a qualified comptroller to join our team in a senior financial role. The comptroller’s job will be to direct and oversee the company’s financial activities, make sure that all regulations are followed, and give financial advice to the company’s management.

Key Roles and Responsibilities:

- Management of Financial Resources Ensuring that all financial records are accurate and complete, and overseeing the organization’s financial systems and processes are all aspects of financial management.

- Budgeting and forecasting entail creating and overseeing the organization’s method of budgeting and forecasting, as well as keeping tabs on and analyzing financial performance relative to plan and suggesting changes.

- Internal Controls and Compliance: Develop and implement internal controls to ensure compliance with laws and regulations, monitor compliance with internal controls, and ensure the accuracy and completeness of financial reporting.

- Preparing and analyzing financial reports and statements; offering financial analysis to management; creating and deploying financial models and tools to aid in decision-making.

- Leadership and Management: Manage and supervise accounting and finance staff, provide training and development opportunities, and ensure a high level of performance and productivity.

Qualifications:

- Bachelor’s degree in accounting, finance, or related field required; MBA or accounting master’s degree preferred.

- A minimum of 7-10 years of experience in accounting or finance is required, with prior experience in a leadership or management role preferred.

- Strong knowledge of accounting and finance principles and practices is required, with familiarity with financial software and systems preferred.

- Excellent analytical and problem-solving skills are required, with proficiency in Microsoft Excel and other financial software necessary.

- Strong communication and interpersonal skills are required, with leadership and management skills preferred.

We offer a competitive salary and benefits package that includes paid time off, health insurance, and retirement plans. If you meet the qualifications and are interested in joining our team as a comptroller, please apply today.

FAQ: Comptroller Job

Q: What is a comptroller?

A: A comptroller is a financial professional who is in charge of managing and overseeing an organization’s financial operations. This includes financial reporting, budgeting and forecasting, internal controls and compliance, and financial analysis.

Q: What are the key responsibilities of a comptroller?

A: A comptroller’s main jobs are to manage financial operations, create and manage budgets and forecasts, make sure that laws and rules are followed, analyze financial data, and give strategic financial advice to management.

Q: What qualifications are required to become a comptroller?

A: To become a comptroller, you usually need a bachelor’s degree in accounting, finance, or a related field. A master’s degree in accounting or business administration may also be preferred. Also needed are strong analytical and communication skills, as well as a few years of experience in accounting or finance.

Q: What skills are necessary for a comptroller?

A: A comptroller needs to be good at analyzing and solving problems and know how to use financial software and systems. They should also be good at communicating and getting along with other people. They should also be able to lead and manage a team well.

Q: What career opportunities are available for a comptroller?

A: A comptroller can work in many different jobs, such as as a chief financial officer, a financial director, or a finance manager. They can also work in many different fields, such as healthcare, education, government, and non-profits.

Q: What is the job outlook for comptrollers?

A: According to the U.S. Bureau of Labor Statistics, employment of financial managers, which includes comptrollers, is projected to grow 15 percent from 2019 to 2029, much faster than the average for all occupations. This growth is due to the increased demand for financial expertise in many industries.