Construction Accountant Job Description:

Construction accountants are responsible for managing and overseeing the financial aspects of construction projects. They work closely with project managers, contractors, and other key players to make sure projects are finished on time and within budget. Some of the common types of construction accounting positions include project accountant, cost accountant, and controller.

Types of Construction Accounting Positions:

- Project Accountant: Responsible for managing the financial aspects of individual construction projects, including budgeting, financial reporting, and analysis.

- Cost Accountant: Manages and tracks project costs, analyzes project data, and develops financial forecasts.

- Controller: Oversees the financial aspects of multiple construction projects and manages the accounting team.

Construction Accountant Responsibilities:

Depending on the role and size of the construction project, a construction accountant may have different tasks to do. However, some common duties include:

Accounting and Financial Analysis:

- Preparing financial statements and analyzing financial data to identify trends and areas for improvement.

- Managing financial accounts, including accounts payable and accounts receivable.

- Conducting audits and financial analyses to ensure accuracy and compliance.

Budget management and Cost Tracking:

- Collaborating with project managers to develop project budgets and monitor expenses.

- Tracking project costs and reporting on budget status to stakeholders.

- Analyzing cost data and identifying opportunities for cost savings.

Payroll and Vendor Management:

- Processing payroll for employees and contractors.

- Managing vendor and contractor payments, ensuring that they are accurate and timely.

- Maintaining financial records for all project-related transactions.

Compliance with Industry and Regulatory Standards:

- Ensuring that all financial transactions comply with industry standards and regulatory requirements.

- Staying up-to-date with changes in tax laws and regulations that affect the construction industry.

- Collaborating with legal and financial experts to manage compliance issues.

Construction Accountant Requirements and Skills:

Most of the time, you need a bachelor’s degree in accounting or a related field to become a construction accountant. Some jobs, like those of a Certified Public Accountant (CPA) or a Certified Construction Industry Financial Professional (CCIFP), may also need certification. Other requirements and skills may include:

Education and Certification Requirements:

- Bachelor’s degree in accounting or a related field.

- Certification as a CPA or CCIFP, depending on the position.

Experience in Accounting or Construction:

- Previous experience in accounting or the construction industry is often required.

Analytical and Problem-Solving Skills:

- Ability to analyze financial data and develop solutions to complex problems.

- Strong critical thinking and problem-solving skills.

Proficiency in Financial Software and Tools:

- Proficient in financial software and tools such as QuickBooks, Excel, and accounting software.

- Experience with construction-specific software, such as Procore, is also beneficial.

Attention to Detail and Strong Communication Skills:

- Strong attention to detail and accuracy.

- Excellent communication and interpersonal skills to collaborate effectively with project managers, contractors, and other stakeholders.

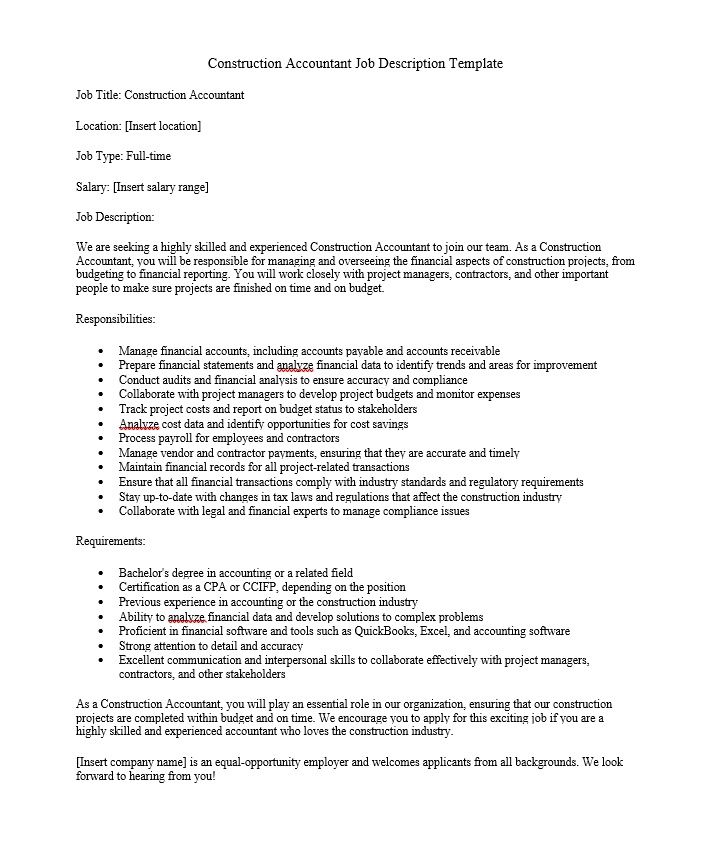

Construction Accountant Job Description Template

Job Title: Construction Accountant

Location: [Insert location]

Job Type: Full-time

Salary: [Insert salary range]

Job Description:

We are seeking a highly skilled and experienced Construction Accountant to join our team. As a Construction Accountant, you will be responsible for managing and overseeing the financial aspects of construction projects, from budgeting to financial reporting. You will work closely with project managers, contractors, and other important people to make sure projects are finished on time and on budget.

Responsibilities:

- Manage financial accounts, including accounts payable and accounts receivable

- Prepare financial statements and analyze financial data to identify trends and areas for improvement

- Conduct audits and financial analysis to ensure accuracy and compliance

- Collaborate with project managers to develop project budgets and monitor expenses

- Track project costs and report on budget status to stakeholders

- Analyze cost data and identify opportunities for cost savings

- Process payroll for employees and contractors

- Manage vendor and contractor payments, ensuring that they are accurate and timely

- Maintain financial records for all project-related transactions

- Ensure that all financial transactions comply with industry standards and regulatory requirements

- Stay up-to-date with changes in tax laws and regulations that affect the construction industry

- Collaborate with legal and financial experts to manage compliance issues

Requirements:

- Bachelor’s degree in accounting or a related field

- Certification as a CPA or CCIFP, depending on the position

- Previous experience in accounting or the construction industry

- Ability to analyze financial data and develop solutions to complex problems

- Proficient in financial software and tools such as QuickBooks, Excel, and accounting software

- Strong attention to detail and accuracy

- Excellent communication and interpersonal skills to collaborate effectively with project managers, contractors, and other stakeholders

As a Construction Accountant, you will play an essential role in our organization, ensuring that our construction projects are completed within budget and on time. We encourage you to apply for this exciting job if you are a highly skilled and experienced accountant who loves the construction industry.

[Insert company name] is an equal-opportunity employer and welcomes applicants from all backgrounds. We look forward to hearing from you!

FAQs: Construction Accountant Job

Q: What is a construction accountant?

A: A construction accountant is responsible for managing the financial aspects of construction projects. They work closely with project managers, contractors, and other key players to make sure projects are finished on time and within budget.

Q: What are the primary responsibilities of a construction accountant?

A: A construction accountant’s main jobs are to manage financial accounts, make financial statements, keep track of project costs, process payroll, handle vendor and contractor payments, keep financial records, and make sure that industry standards and government regulations are followed.

Q: What qualifications are required to become a construction accountant?

A: A bachelor’s degree in accounting or a closely related field is typically required for employment as a construction accountant. For some jobs, you might also need a CPA or CCIFP credential. Having a background in accounting or the construction industry is also usually required.

Q: What skills are necessary for a successful construction accountant?

A: To be a good construction accountant, you need to be good at analysis, pay attention to details, and know how to use software and tools like QuickBooks and Excel. To work well with project managers, contractors, and other stakeholders, they also need to be good at communicating and getting along with other people.

Q: What is the job outlook for construction accountants?

A: The job outlook for construction accountants is positive, with a projected growth rate of 6% from 2020 to 2030, according to the Bureau of Labor Statistics. As the construction industry grows, there will likely be more jobs for construction accountants.

Q: What is the average salary for a construction accountant?

A: The average salary for a construction accountant varies depending on location, experience, and certification. According to Payscale, the average salary for a construction accountant in the United States is around $63,000 per year.

Q: What opportunities for career advancement are available for construction accountants?

A: Construction accountants may be able to move up in their organization and become senior accountants or financial managers, for example. They may also choose to get advanced certifications like the Certified Construction Industry Financial Professional (CCIFP) certification to improve their credentials and job prospects.