Corporate Accountant

The role of a corporate accountant can vary depending on the size and nature of the company they work for. But in general, a corporate accountant’s job is to manage and analyze financial data, make financial reports and statements, and make sure that tax laws and rules are followed.

Corporate Accountant Responsibilities

The responsibilities of a corporate accountant can include:

- Financial Reporting – Preparing regular financial reports and statements, such as balance sheets, income statements, and cash flow statements, to provide management with an accurate picture of the company’s financial health.

- Budgeting – Developing and monitoring budgets to ensure that the company’s financial resources are used effectively and efficiently.

- Tax Compliance – Ensuring that the company complies with all applicable tax laws and regulations, including filing tax returns and paying taxes on time.

- Auditing – Working with internal and external auditors to ensure that financial records are accurate and that the company’s financial practices are sound.

Corporate Accountant Requirements and Skills

Usually, you need a bachelor’s degree in accounting or a related field and a professional certification like Certified Public Accountant (CPA) or Certified Management Accountant (CMA) to become a corporate accountant. In addition, you will need to have strong analytical skills, attention to detail, and proficiency in accounting software such as QuickBooks, SAP, or Oracle.

Other essential skills for a corporate accountant include:

- Communication Skills – Strong written and verbal communication skills are essential in corporate accounting, as accountants must be able to explain complex financial data to non-financial stakeholders.

- Analytical Thinking – The ability to analyze financial data and identify trends and patterns is critical for making informed financial decisions.

- Attention to Detail – Corporate accountants must have a keen eye for detail to ensure that financial data is accurate and complete.

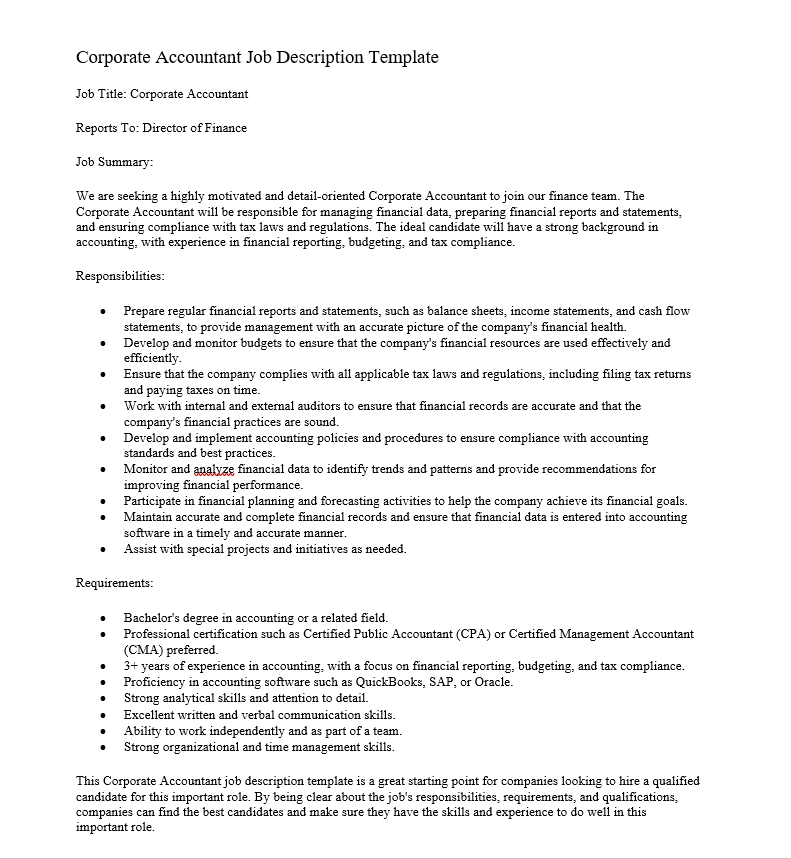

Corporate Accountant Job Description Template

Job Title: Corporate Accountant

Reports To: Director of Finance

Job Summary:

We are seeking a highly motivated and detail-oriented Corporate Accountant to join our finance team. The Corporate Accountant will be responsible for managing financial data, preparing financial reports and statements, and ensuring compliance with tax laws and regulations. The ideal candidate will have a strong background in accounting, with experience in financial reporting, budgeting, and tax compliance.

Responsibilities:

- Prepare regular financial reports and statements, such as balance sheets, income statements, and cash flow statements, to provide management with an accurate picture of the company’s financial health.

- Develop and monitor budgets to ensure that the company’s financial resources are used effectively and efficiently.

- Ensure that the company complies with all applicable tax laws and regulations, including filing tax returns and paying taxes on time.

- Work with internal and external auditors to ensure that financial records are accurate and that the company’s financial practices are sound.

- Develop and implement accounting policies and procedures to ensure compliance with accounting standards and best practices.

- Monitor and analyze financial data to identify trends and patterns and provide recommendations for improving financial performance.

- Participate in financial planning and forecasting activities to help the company achieve its financial goals.

- Maintain accurate and complete financial records and ensure that financial data is entered into accounting software in a timely and accurate manner.

- Assist with special projects and initiatives as needed.

Requirements:

- Bachelor’s degree in accounting or a related field.

- Professional certification such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA) preferred.

- 3+ years of experience in accounting, with a focus on financial reporting, budgeting, and tax compliance.

- Proficiency in accounting software such as QuickBooks, SAP, or Oracle.

- Strong analytical skills and attention to detail.

- Excellent written and verbal communication skills.

- Ability to work independently and as part of a team.

- Strong organizational and time management skills.

This Corporate Accountant job description template is a great starting point for companies looking to hire a qualified candidate for this important role. By being clear about the job’s responsibilities, requirements, and qualifications, companies can find the best candidates and make sure they have the skills and experience to do well in this important role.

-

What does a Corporate Accountant do?

A Corporate Accountant is responsible for managing a company’s financial data, preparing financial reports and statements, ensuring compliance with tax laws and regulations, and developing and monitoring budgets. They also work with internal and external auditors to make sure that financial records are correct and to create accounting policies and procedures.

-

What qualifications are needed to become a Corporate Accountant?

A Bachelor’s degree in accounting or a related field is typically required. Certified Public Accountant (CPA) or Certified Management Accountant (CMA) certifications are preferred. Candidates should also have at least 3 years of experience in accounting, with a focus on financial reporting, budgeting, and tax compliance. Proficiency in accounting software and strong analytical, communication, and organizational skills are also important.

-

What are the key skills of a Corporate Accountant?

Key skills for a Corporate Accountant include strong analytical skills, attention to detail, proficiency in accounting software, excellent written and verbal communication skills, ability to work independently and as part of a team, and strong organizational and time management skills.

-

What is the salary range for a Corporate Accountant?

The salary range for a Corporate Accountant can vary depending on factors such as experience, location, and company size. According to PayScale, the average salary for a Corporate Accountant in the United States is approximately $62,000 per year.

-

What career advancement opportunities are available for a Corporate Accountant?

Corporate Accountants can advance in their careers by taking on roles such as Accounting Manager, Director of Finance, or Chief Financial Officer. They can also get professional certifications like Certified Public Accountant (CPA) or Certified Management Accountants (CMA) to increase their knowledge and skills and improve their career prospects.

-

What industries hire Corporate Accountants?

Corporate Accountants are needed in a variety of industries, including finance, healthcare, technology, manufacturing, and retail. Companies of all sizes and types require the services of skilled Corporate Accountants to manage their financial data and ensure compliance with tax laws and regulations.