Corporate Controller Job Description:

The corporate controller is in charge of running an organization’s accounting and money matters. They make sure that the company’s financial practices are in line with regulations and accounting standards. They also manage the budgeting process and make sure that the financial statements are accurate. The corporate controller reports directly to the Chief Financial Officer (CFO) and may also be in charge of a team of accounting and finance professionals.

Key Duties and Responsibilities:

- Oversee the preparation of financial statements and ensure that they are accurate and comply with accounting standards.

- Develop and manage the budgeting and forecasting process.

- Manage the day-to-day accounting operations, including accounts payable, accounts receivable, and payroll.

- Develop and implement financial policies and procedures to ensure compliance with regulations and accounting standards.

- Manage the audit process and work with external auditors to ensure compliance with regulatory requirements.

- Provide financial analysis and insights to the CFO and other senior executives.

Corporate Controller Responsibilities:

Financial Planning and Analysis:

- Develop and manage the annual budgeting process.

- Conduct financial analysis to identify trends, risks, and opportunities.

- Provide financial insights to senior management to support decision-making.

Budgeting and Forecasting:

- Develop and manage the company’s financial forecasts.

- Identify areas of financial risk and develop strategies to mitigate them.

- Monitor and report on actual vs. budgeted performance.

Financial Reporting and Analysis:

- Prepare accurate and timely financial statements in compliance with accounting standards.

- Develop and implement financial policies and procedures to ensure compliance with regulations and accounting standards.

- Oversee the audit process and work with external auditors to ensure compliance with regulatory requirements.

Risk Management and Internal Controls:

- Develop and implement risk management policies and procedures.

- Ensure that internal controls are in place and operating effectively.

- Identify areas of financial risk and develop strategies to mitigate them.

Corporate Controller Requirements and Skills:

Educational Requirements:

- A Bachelor’s degree in accounting, finance, or a related field is typically required.

- A CPA (Certified Public Accountant) certification is highly preferred.

- Relevant professional certifications such as CMA (Certified Management Accountant) or CIA (Certified Internal Auditor) may also be beneficial.

Technical Skills:

- Strong knowledge of accounting principles and practices.

- Experience with financial reporting and analysis.

- Proficiency in using financial management software and tools.

Analytical Skills:

- Ability to analyze financial data and identify trends and patterns.

- Ability to interpret and communicate financial information to non-financial stakeholders.

- Experience with financial modeling and forecasting.

Communication and Leadership Skills:

- Strong communication and interpersonal skills.

- Ability to lead and motivate a team of accounting and finance professionals.

- Experience in presenting financial information to senior management and external stakeholders.

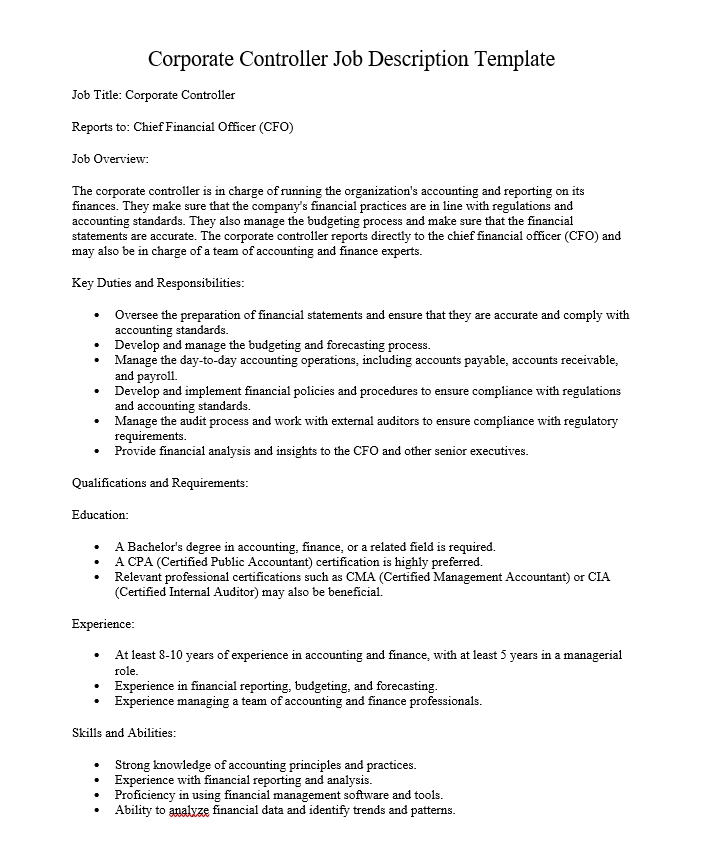

Corporate Controller Job Description Template

Job Title: Corporate Controller

Reports to: Chief Financial Officer (CFO)

Job Overview:

The corporate controller is in charge of running the organization’s accounting and reporting on its finances. They make sure that the company’s financial practices are in line with regulations and accounting standards. They also manage the budgeting process and make sure that the financial statements are accurate. The corporate controller reports directly to the chief financial officer (CFO) and may also be in charge of a team of accounting and finance experts.

Key Duties and Responsibilities:

- Oversee the preparation of financial statements and ensure that they are accurate and comply with accounting standards.

- Develop and manage the budgeting and forecasting process.

- Manage the day-to-day accounting operations, including accounts payable, accounts receivable, and payroll.

- Develop and implement financial policies and procedures to ensure compliance with regulations and accounting standards.

- Manage the audit process and work with external auditors to ensure compliance with regulatory requirements.

- Provide financial analysis and insights to the CFO and other senior executives.

Qualifications and Requirements:

Education:

- A Bachelor’s degree in accounting, finance, or a related field is required.

- A CPA (Certified Public Accountant) certification is highly preferred.

- Relevant professional certifications such as CMA (Certified Management Accountant) or CIA (Certified Internal Auditor) may also be beneficial.

Experience:

- At least 8-10 years of experience in accounting and finance, with at least 5 years in a managerial role.

- Experience in financial reporting, budgeting, and forecasting.

- Experience managing a team of accounting and finance professionals.

Skills and Abilities:

- Strong knowledge of accounting principles and practices.

- Experience with financial reporting and analysis.

- Proficiency in using financial management software and tools.

- Ability to analyze financial data and identify trends and patterns.

- Ability to interpret and communicate financial information to non-financial stakeholders.

- Strong communication and interpersonal skills.

- Ability to lead and motivate a team of accounting and finance professionals.

- Experience in presenting financial information to senior management and external stakeholders.

This job description is meant to help you understand the scope of the corporate controller’s job. It is not meant to be a full list of qualifications, duties, or responsibilities that come with the job. The company reserves the right to modify the job description at any time.

-

What is a corporate controller?

A corporate controller is a high-ranking executive who is in charge of an organization’s accounting and financial reporting. They make sure that the company’s financial practices are in line with regulations and accounting standards. They also manage the budgeting process and make sure that the financial statements are accurate.

-

What are the responsibilities of a corporate controller?

A corporate controller’s responsibilities include overseeing the preparation of financial statements, managing the budgeting and forecasting process, managing the day-to-day accounting operations, creating and implementing financial policies and procedures, managing the audit process, and giving senior executives financial analysis and insights.

-

What qualifications are required to become a corporate controller?

A Bachelor’s degree in accounting, finance, or a related field is required, along with at least 8–10 years of experience in accounting and finance, with at least 5 years in a managerial role. Certified Public Accountant (CPA) or Certified Management Accountant (CMA) or Certified Internal Auditor (CIA) certifications may also be helpful.

-

What skills are required to become a successful corporate controller?

Corporate controllers who are good at their jobs need to know a lot about accounting principles and practices, have experience with financial reporting and analysis, be good at using financial management software and tools, be able to look at financial data and find trends and patterns, be able to explain financial information to people who aren’t in finance, have good communication and people skills, and be able to lead and motivate a team of people.

-

What career opportunities are available for corporate controllers?

Corporate controllers can work their way up to more senior positions in the finance department, such as CFO or VP of Finance. Corporate controllers can also choose to specialize in a certain area of finance, like treasury or taxes, or move into a related field, like consulting or investment banking.

-

What are the benefits of becoming a corporate controller?

If you are interested in money and accounting, becoming a corporate controller can be a rewarding job. The role offers a high level of responsibility, the opportunity to work with senior executives and make strategic decisions, and the potential for career advancement and financial rewards. Corporate controllers are also in high demand in many different industries, which gives them job security and stability.