Payroll Accountant Job Description

As a payroll accountant, it will be your job to manage and process an organization’s payroll. This includes figuring out and processing employee salaries and wages, taking care of employee benefits like health insurance and retirement plans, and making sure that all taxes and other deductions are calculated and processed correctly.

In addition, you will be responsible for maintaining accurate payroll records and files and responding to employee inquiries regarding payroll and benefits.

Payroll Accountant Responsibilities

The responsibilities of a payroll accountant can be summarized as follows:

- Payroll processing and management include calculating and processing employee wages and salaries, managing employee benefits, and making sure that all taxes and other deductions are calculated and processed correctly.

- Payroll accountants are responsible for keeping accurate payroll records and files, which include tax forms, employment contracts, and other important documents.

- Calculating payroll taxes and other deductions: This includes calculating and processing payroll taxes, as well as other deductions such as social security and Medicare contributions.

- Payroll accountants are responsible for making sure that all payroll-related activities follow all relevant laws and rules, such as tax laws and labor laws.

- Providing customer service to employees: Payroll accountants are often the first point of contact for employees with questions or concerns about their payroll or benefits, and must therefore have strong customer service skills.

Payroll Accountant Requirements and Skills

Most of the time, you need a degree in accounting, finance, or a related field if you want to work as a payroll accountant. Some companies may also want you to have a professional certification, like the Certified Payroll Professional (CPP) title. In addition to these formal requirements, this job also calls for strong technical skills, such as being able to use payroll software and systems.

As a payroll accountant, you also need to be good at analyzing and solving problems, paying attention to details and being accurate, and having good communication and people skills.

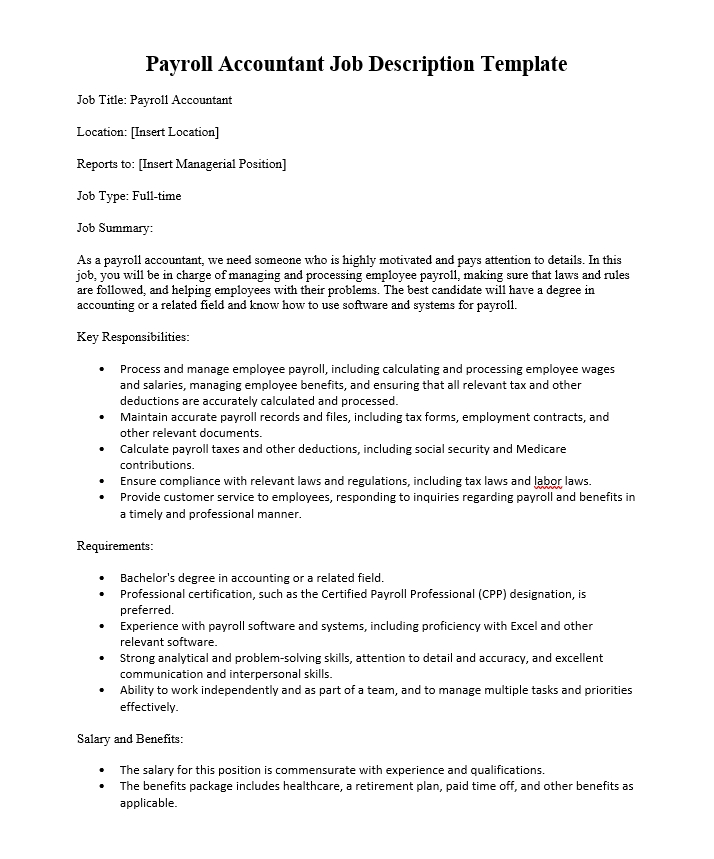

Payroll Accountant Job Description Template

Job Title: Payroll Accountant

Location: [Insert Location]

Reports to: [Insert Managerial Position]

Job Type: Full-time

Job Summary:

As a payroll accountant, we need someone who is highly motivated and pays attention to details. In this job, you will be in charge of managing and processing employee payroll, making sure that laws and rules are followed, and helping employees with their problems. The best candidate will have a degree in accounting or a related field and know how to use software and systems for payroll.

Key Responsibilities:

- Process and manage employee payroll, including calculating and processing employee wages and salaries, managing employee benefits, and ensuring that all relevant tax and other deductions are accurately calculated and processed.

- Maintain accurate payroll records and files, including tax forms, employment contracts, and other relevant documents.

- Calculate payroll taxes and other deductions, including social security and Medicare contributions.

- Ensure compliance with relevant laws and regulations, including tax laws and labor laws.

- Provide customer service to employees, responding to inquiries regarding payroll and benefits in a timely and professional manner.

Requirements:

- Bachelor’s degree in accounting or a related field.

- Professional certification, such as the Certified Payroll Professional (CPP) designation, is preferred.

- Experience with payroll software and systems, including proficiency with Excel and other relevant software.

- Strong analytical and problem-solving skills, attention to detail and accuracy, and excellent communication and interpersonal skills.

- Ability to work independently and as part of a team, and to manage multiple tasks and priorities effectively.

Salary and Benefits:

- The salary for this position is commensurate with experience and qualifications.

- The benefits package includes healthcare, a retirement plan, paid time off, and other benefits as applicable.

Q: What does a payroll accountant do?

A: A payroll accountant is responsible for managing and processing payroll for an organization. This includes figuring out and processing employee salaries and wages, taking care of employee benefits like health insurance and retirement plans, and making sure that all taxes and other deductions are calculated and processed correctly. Payroll accountants also keep accurate payroll records and files and respond to employee questions about payroll and benefits.

Q: What qualifications do I need to become a payroll accountant?

A: To become a payroll accountant, most people need a bachelor’s degree in accounting, finance, or a related field. Some companies may also want you to have a professional certification, like the Certified Payroll Professional (CPP) title. Strong technical skills are also important for this role, such as knowing how to use payroll software and systems. As a payroll accountant, you also need to be good at analyzing and solving problems, paying attention to details and being accurate, and having good communication and people skills.

Q: What is the salary range for a payroll accountant?

A: According to the U.S. Bureau of Labor Statistics, the median annual salary for payroll and timekeeping clerks was $48,500 as of May 2020. Payroll accountants’ salaries can vary based on things like where they work, how much experience they have, and what industry they work in.

Q: What are some common challenges faced by payroll accountants?

A: Payroll accountants may face challenges related to managing complex payroll systems, staying up-to-date with changing tax and labor laws, and ensuring accuracy and compliance with relevant regulations. They may also encounter challenges related to managing employee inquiries and concerns regarding payroll and benefits.

Q: What skills are necessary for success as a payroll accountant?

A: For this job, it’s important to have strong technical skills, like knowing how to use payroll software and systems. As a payroll accountant, you also need to be good at analyzing and solving problems, paying attention to details and being accurate, and having good communication and people skills. Additionally, payroll accountants should have a strong understanding of relevant tax and labor laws and regulations, and the ability to stay up-to-date with changes and updates in these areas.

Q: What career growth opportunities are available for payroll accountants?

A: Payroll accountants may have opportunities for career advancement within their organization, such as moving into management or senior accounting roles. They may also choose to pursue professional certification, such as the Certified Payroll Professional (CPP) designation, to demonstrate their expertise in the field. Additionally, payroll accountants may explore opportunities in related fields such as accounting, finance, or human resources.