Payroll Administrator Job Description

A payroll administrator is a professional who manages an organization’s payroll system. They are responsible for calculating employee wages, taxes, and deductions, and ensuring that employees are paid accurately and on time. A payroll administrator is also in charge of keeping employee records up to date and making sure they are correct. They also need to know about labor laws and regulations to make sure they are following the law.

Payroll Administrator Responsibilities

The responsibilities of a payroll administrator are varied and include:

-

Maintaining Accurate Employee Records

Payroll administrators need to ensure that employee records are accurate and up-to-date. This means checking information about employees, like their addresses and social security numbers, and keeping accurate records of hours worked overtime, and sick leave.

-

Processing Payroll and Related Tasks

Payroll administrators are in charge of processing payroll and other related tasks, such as figuring out employee wages, taxes, and deductions, giving out paychecks, and making tax forms.

-

Ensuring Compliance with Labor Laws and Regulations

Payroll administrators need to know about labor laws and rules so that they can make sure the law is followed. They need to be aware of minimum wage laws, overtime regulations, and tax laws.

Payroll Administrator Requirements and Skills

Most of the time, you need a degree in accounting, finance, or a related field if you want to be a payroll administrator. Some employers may want you to have experience running payroll, while others may train you on the job. Essential skills for the role include:

-

Attention to Detail

Administrators of payroll must be careful and accurate in their work because even small mistakes can have big effects.

-

Analytical Skills

Payroll administrators need to be able to look at and understand complicated data, like tax rules and employee records.

-

Communication Skills

Payroll administrators need to be able to talk to employees, managers, and other people who have a stake in the business.

-

Time Management

To make sure payroll is done correctly and on time, payroll administrators need to be able to organize their work and manage their time well.

Payroll administrators also need to know how to use software and technology like accounting software, spreadsheet programs, and payroll software.

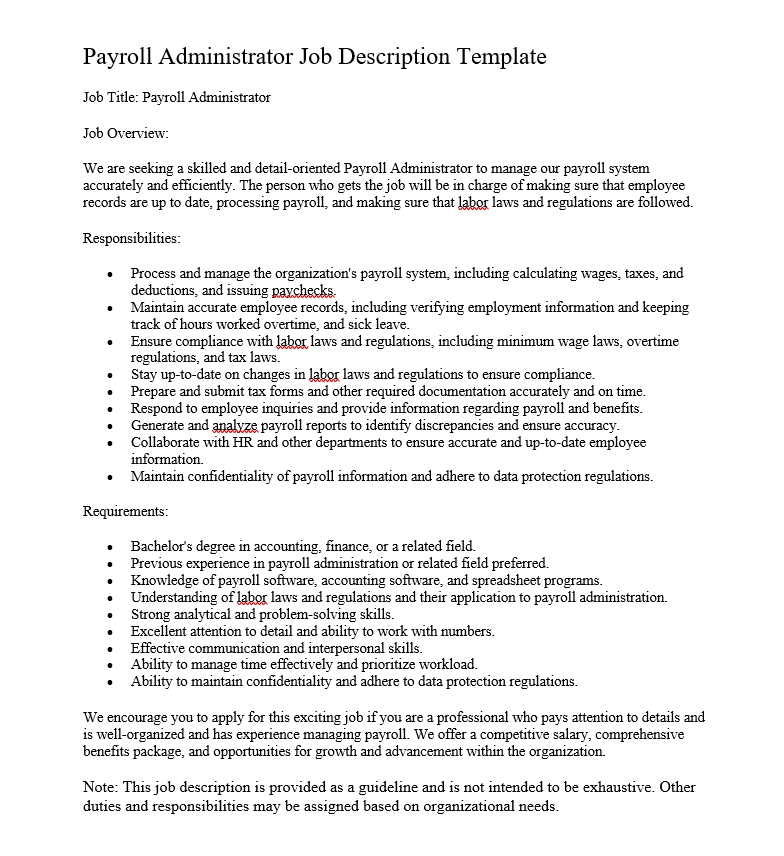

Payroll Administrator Job Description Template

Job Title: Payroll Administrator

Job Overview:

We are seeking a skilled and detail-oriented Payroll Administrator to manage our payroll system accurately and efficiently. The person who gets the job will be in charge of making sure that employee records are up to date, processing payroll, and making sure that labor laws and regulations are followed.

Responsibilities:

- Process and manage the organization’s payroll system, including calculating wages, taxes, and deductions, and issuing paychecks.

- Maintain accurate employee records, including verifying employment information and keeping track of hours worked overtime, and sick leave.

- Ensure compliance with labor laws and regulations, including minimum wage laws, overtime regulations, and tax laws.

- Stay up-to-date on changes in labor laws and regulations to ensure compliance.

- Prepare and submit tax forms and other required documentation accurately and on time.

- Respond to employee inquiries and provide information regarding payroll and benefits.

- Generate and analyze payroll reports to identify discrepancies and ensure accuracy.

- Collaborate with HR and other departments to ensure accurate and up-to-date employee information.

- Maintain confidentiality of payroll information and adhere to data protection regulations.

Requirements:

- Bachelor’s degree in accounting, finance, or a related field.

- Previous experience in payroll administration or related field preferred.

- Knowledge of payroll software, accounting software, and spreadsheet programs.

- Understanding of labor laws and regulations and their application to payroll administration.

- Strong analytical and problem-solving skills.

- Excellent attention to detail and ability to work with numbers.

- Effective communication and interpersonal skills.

- Ability to manage time effectively and prioritize workload.

- Ability to maintain confidentiality and adhere to data protection regulations.

We encourage you to apply for this exciting job if you are a professional who pays attention to details and is well-organized and has experience managing payroll. We offer a competitive salary, a comprehensive benefits package, and opportunities for growth and advancement within the organization.

Note: This job description is provided as a guideline and is not intended to be exhaustive. Other duties and responsibilities may be assigned based on organizational needs.

Q: What is a Payroll Administrator?

A: A Payroll Administrator is a professional responsible for managing an organization’s payroll system accurately and efficiently. This includes processing employee wages, taxes, and deductions, maintaining employee records, ensuring compliance with labor laws and regulations, and responding to employee inquiries.

Q: What are the key responsibilities of a Payroll Administrator?

A: The key responsibilities of a Payroll Administrator include managing the organization’s payroll system, maintaining accurate employee records, ensuring compliance with labor laws and regulations, staying up-to-date on changes in labor laws and regulations, preparing and submitting tax forms and other required documentation accurately and on time, generating and analyzing payroll reports, collaborating with HR and other departments to ensure accurate and up-to-date employee information, maintaining confidentiality of payroll information, and adhering to data protection regulations.

Q: What qualifications are required to become a Payroll Administrator?

A: Usually, you need a Bachelor’s degree in accounting, finance, or a related field to become a Payroll Administrator. Previous experience in payroll administration or a related field is preferred. Other important qualifications include knowledge of payroll software, accounting software, and spreadsheet programs, understanding of labor laws and regulations and their application to payroll administration, strong analytical and problem-solving skills, excellent attention to detail and ability to work with numbers, effective communication and interpersonal skills, ability to manage time effectively and prioritize workload, and ability to maintain confidentiality and adhere to data protection regulations.

Q: What are the benefits of working as a Payroll Administrator?

A: Working as a Payroll Administrator can be a fulfilling and rewarding career path. Some of the benefits of this role include the opportunity to work in a dynamic and fast-paced environment, the ability to make a meaningful impact on an organization’s financial operations, competitive salaries and comprehensive benefits packages, and opportunities for growth and advancement within the organization.

Q: What are some common challenges faced by Payroll Administrators?

A: Payroll Administrators face a variety of challenges in their role, including keeping up-to-date with changing labor laws and regulations, managing large volumes of data accurately and efficiently, responding to employee inquiries and resolving payroll-related issues, collaborating with HR and other departments effectively, and maintaining confidentiality of sensitive payroll information.

Q: How can I become a Payroll Administrator?

A: To become a Payroll Administrator, you typically need a Bachelor’s degree in accounting, finance, or a related field, as well as previous experience in payroll administration or a related field. You can also get experience and skills that are useful by doing internships or starting out in finance or accounting. Additionally, it is important to stay up-to-date on changes in labor laws and regulations and to continue developing your skills in payroll software, accounting software, and spreadsheet programs.