Payroll Clerk Job Description

A payroll clerk is responsible for managing the day-to-day activities of the payroll department. Their primary role is to ensure that employees receive accurate and timely pay. The payroll clerk reports to the payroll manager and works closely with other members of the finance and HR teams.

Reporting Structure and Hierarchy

Usually, the payroll clerk works for the payroll manager, who is in charge of the payroll department. In larger organizations, the payroll clerk may report to a senior payroll clerk or team leader.

Typical Work Environment

A payroll clerk works in an office setting and spends most of their time working on a computer. They may also need to talk to other departments, like HR, to get employee information and solve any problems with payroll.

Payroll Clerk Responsibilities

- Collecting and organizing employee data: The payroll clerk is responsible for collecting and organizing employee data, including hours worked, pay rates, and benefits.

- Calculating wages, bonuses, and overtime pay: The payroll clerk must accurately calculate wages, bonuses, and overtime pay based on employee data.

- Updating employee records and payroll databases: The payroll clerk is responsible for updating employee records and payroll databases to ensure accuracy.

- Preparing and distributing payroll checks and reports: The payroll clerk must prepare and distribute payroll checks and reports to employees.

- Responding to employee inquiries and concerns: The payroll clerk must address employee inquiries and concerns related to payroll.

- Ensuring compliance with tax and labor laws: The payroll clerk must ensure compliance with tax and labor laws, including withholding taxes and processing payroll deductions.

Payroll Clerk Requirements and Skills

- Educational qualifications: A payroll clerk typically has a high school diploma or equivalent. Some employers may prefer candidates with an associate’s or bachelor’s degree in accounting or a related field.

- Relevant work experience: Employers may prefer candidates with previous experience working in a payroll or accounting role.

- Attention to detail: A payroll clerk must have excellent attention to detail to ensure accurate payroll processing.

- Strong organizational and time-management skills: A payroll clerk must be highly organized and have strong time-management skills to meet payroll deadlines.

- Proficiency in relevant software and tools: A payroll clerk must be proficient in relevant software and tools, such as payroll processing software and Microsoft Excel.

- Excellent communication and interpersonal abilities: A payroll clerk must have excellent communication and interpersonal skills to address employee inquiries and concerns.

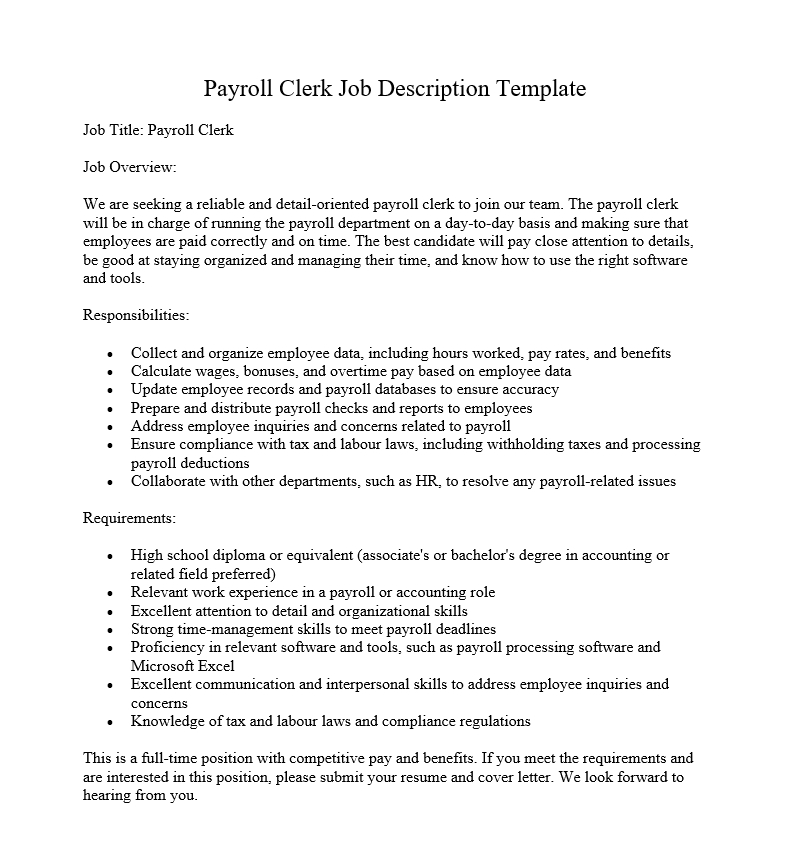

Payroll Clerk Job Description Template

Job Title: Payroll Clerk

Job Overview:

We are seeking a reliable and detail-oriented payroll clerk to join our team. The payroll clerk will be in charge of running the payroll department on a day-to-day basis and making sure that employees are paid correctly and on time. The best candidate will pay close attention to details, be good at staying organized and managing their time, and know how to use the right software and tools.

Responsibilities:

- Collect and organize employee data, including hours worked, pay rates, and benefits

- Calculate wages, bonuses, and overtime pay based on employee data

- Update employee records and payroll databases to ensure accuracy

- Prepare and distribute payroll checks and reports to employees

- Address employee inquiries and concerns related to payroll

- Ensure compliance with tax and labor laws, including withholding taxes and processing payroll deductions

- Collaborate with other departments, such as HR, to resolve any payroll-related issues

Requirements:

- High school diploma or equivalent (associate’s or bachelor’s degree in accounting or related field preferred)

- Relevant work experience in a payroll or accounting role

- Excellent attention to detail and organizational skills

- Strong time-management skills to meet payroll deadlines

- Proficiency in relevant software and tools, such as payroll processing software and Microsoft Excel

- Excellent communication and interpersonal skills to address employee inquiries and concerns

- Knowledge of tax and labor laws and compliance regulations

This is a full-time position with competitive pay and benefits. If you meet the requirements and are interested in this position, please submit your resume and cover letter. We look forward to hearing from you.

What does a payroll clerk do?

A payroll clerk is in charge of the day-to-day operations of the payroll department and makes sure that employees are paid correctly and on time. They collect and organize information about employees, figure out wages, keep employee records and payroll databases up to date, and give out paychecks and reports. They also deal with questions and concerns from employees about payroll and make sure tax and labor laws are followed.

What skills are required to be a payroll clerk?

A payroll clerk should pay close attention to details, be good at staying organized and managing their time, and know how to use tools and software like payroll processing software and Microsoft Excel. They should also know tax, labor, and compliance laws and have good communication and people skills so they can answer employee questions and deal with problems.

What education and experience is required for a payroll clerk position?

A high school diploma or equivalent is typically required for a payroll clerk position, with relevant work experience in a payroll or accounting role. An associate’s or bachelor’s degree in accounting or a related field is preferred.

What are the main responsibilities of a payroll clerk?

A payroll clerk’s main jobs are to collect and organize employee information, figure out wages, keep employee records and payroll databases up to date, make payroll checks and reports for employees, answer employee questions and concerns about payroll, and make sure tax and labor laws are followed.

What is the salary range for a payroll clerk?

The salary range for a payroll clerk varies depending on location, company size, and experience. According to payscale.com, the average salary for a payroll clerk in the United States is around $17.00 per hour, with a salary range of $12.00 to $24.00 per hour.

What are some common software tools used by payroll clerks?

Payroll processing software such as ADP, Paychex, and Gusto are commonly used by payroll clerks, as well as Microsoft Excel for spreadsheet management. Other tools and software may vary depending on company and industry.