Payroll Coordinator Job Description

The Payroll Coordinator is a crucial member of any company’s payroll team. They are in charge of the payroll process, which includes getting and processing employee time cards, figuring out paychecks, and making sure all taxes and deductions are recorded correctly. They typically report to the Payroll Manager or Director.

Job Title and Hierarchy

The job title of a Payroll Coordinator may vary from company to company. However, this position is usually considered an entry-level position in the payroll department. The hierarchy may look like this:

- Payroll Director/Manager

- Payroll Coordinator

- Payroll Clerk

Primary Responsibilities

The primary responsibilities of a Payroll Coordinator include:

- Collecting and verifying employee timecards

- Calculating paychecks and ensuring accuracy

- Distributing paychecks or processing direct deposit payments

- Maintaining accurate payroll records and documentation

- Resolving payroll issues and answering employee questions

- Ensuring compliance with labor laws and regulations

Work Environment and Schedule

Payroll Coordinators typically work in an office setting and may work full-time or part-time. They may work during regular business hours or may have a flexible schedule depending on the needs of the company.

Payroll Coordinator Responsibilities

Payroll Coordinators have several important responsibilities, including:

Payroll Processing and Documentation

The Payroll Coordinator is responsible for processing payroll and maintaining accurate payroll documentation. They must make sure that all paperwork related to payroll is correct and up to date. This includes employee timesheets, pay rates, and information about how much tax is taken out.

Time and Attendance Management

The Payroll Coordinator is responsible for managing employee time and attendance records. They have to make sure that all employees are keeping track of their time correctly and that requests for time off are approved on time.

Tax Withholding and Reporting

The payroll coordinator is in charge of figuring out and taking out all taxes from employee paychecks. To the appropriate government agencies, they must also report payroll taxes.

Payroll Issue Resolution

The Payroll Coordinator is responsible for resolving any payroll issues or discrepancies that may arise. They must work closely with employees to ensure that all payroll-related issues are resolved quickly and accurately.

Compliance with Labor Laws and Regulations

The Payroll Coordinator must ensure that the company is in compliance with all labor laws and regulations related to payroll processing. They must stay up-to-date on any changes to labor laws and regulations and ensure that the company is in compliance.

Payroll Coordinator Requirements and Skills

To become a Payroll Coordinator, you typically need a high school diploma or equivalent. Some employers might want you to have a two-year or four-year degree in accounting, finance, or a related field. Other requirements may include:

Education and Experience

Even though a high school diploma is a minimum requirement, some employers may prefer candidates with an associate’s or bachelor’s degree in accounting, finance, or a related field. Relevant work experience in payroll processing or accounting may also be preferred.

Technical Skills

Payroll Coordinators must have excellent computer skills, including proficiency in Microsoft Excel and other payroll software. They must be able to input and manipulate data accurately and efficiently.

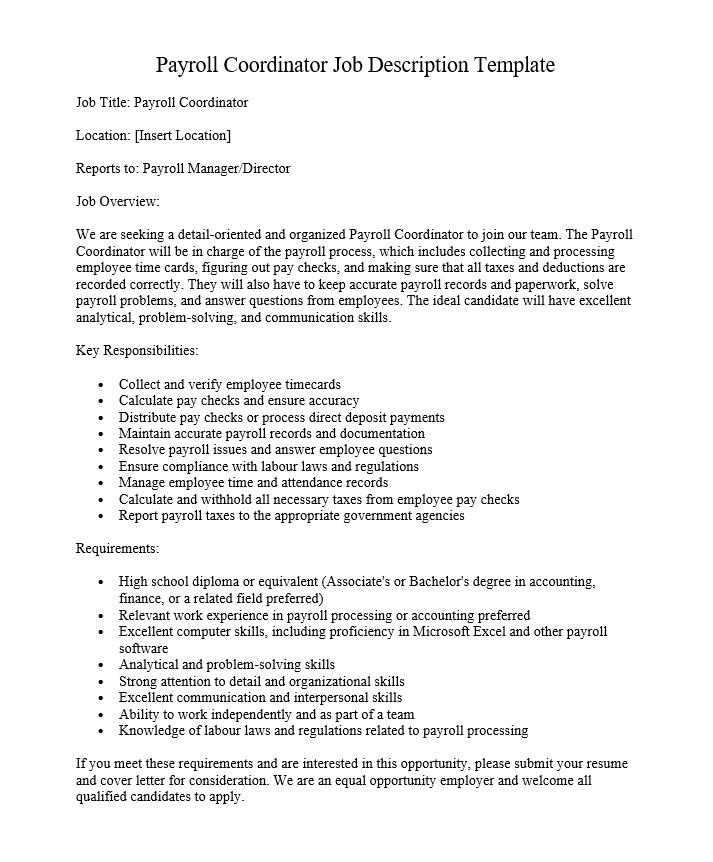

Payroll Coordinator Job Description Template

Job Title: Payroll Coordinator

Location: [Insert Location]

Reports to: Payroll Manager/Director

Job Overview:

We are seeking a detail-oriented and organized Payroll Coordinator to join our team. The Payroll Coordinator will be in charge of the payroll process, which includes collecting and processing employee time cards, figuring out paychecks, and making sure that all taxes and deductions are recorded correctly. They will also have to keep accurate payroll records and paperwork, solve payroll problems, and answer questions from employees. The ideal candidate will have excellent analytical, problem-solving, and communication skills.

Key Responsibilities:

- Collect and verify employee timecards

- Calculate paychecks and ensure accuracy

- Distribute paychecks or process direct deposit payments

- Maintain accurate payroll records and documentation

- Resolve payroll issues and answer employee questions

- Ensure compliance with labor laws and regulations

- Manage employee time and attendance records

- Calculate and withhold all necessary taxes from employee paychecks

- Report payroll taxes to the appropriate government agencies

Requirements:

- High school diploma or equivalent (Associate’s or Bachelor’s degree in accounting, finance, or a related field preferred)

- Relevant work experience in payroll processing or accounting preferred

- Excellent computer skills, including proficiency in Microsoft Excel and other payroll software

- Analytical and problem-solving skills

- Strong attention to detail and organizational skills

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Knowledge of labor laws and regulations related to payroll processing

If you meet these requirements and are interested in this opportunity, please submit your resume and cover letter for consideration. We are an equal opportunity employer and welcome all qualified candidates to apply.

Q: What is a payroll coordinator?

A: A payroll coordinator is responsible for managing the payroll process, including collecting and processing employee timecards, calculating paychecks, and ensuring all taxes and deductions are accurately recorded. They also have to keep accurate payroll records and paperwork, deal with payroll problems, and answer questions from employees.

Q: What are the qualifications required to become a payroll coordinator?

A: The minimum requirement to become a payroll coordinator is a high school diploma or equivalent. But it is best to have an Associate’s or Bachelor’s degree in accounting, finance, or a similar field. Relevant work experience in payroll processing or accounting is also preferred.

Q: What are the key responsibilities of a payroll coordinator?

A payroll coordinator’s main duties include managing employee time and attendance records, collecting and verifying employee timecards, calculating paychecks and ensuring accuracy, distributing paychecks or processing direct deposit payments, maintaining accurate payroll records and documentation, resolving payroll issues and answering employee questions, assuring compliance with labor laws and regulations, and calculating and withholding all necessary taxes.

Q: What skills are required to become a successful payroll coordinator?

A: A successful payroll coordinator should possess strong computer skills, including expertise in Microsoft Excel and other payroll software, analytical and problem-solving abilities, strong attention to detail and organizational abilities, excellent communication and interpersonal skills, the capacity to work both independently and as a member of a team, and knowledge of labor laws and regulations pertaining to payroll processing.

Q: What is the work environment like for a payroll coordinator?

A: Payroll coordinators typically work in an office setting and may collaborate with others individually or as a team. Other departments, like accounting and human resources, may also come into contact with them.

Q: What is the career growth potential for a payroll coordinator?

A: Payroll coordinators may have the opportunity to advance to higher-level payroll positions, such as payroll manager or payroll director. They may also have opportunities to move into related fields, such as accounting or human resources. Professional development through certifications and continuing education may also be available.