Payroll Director Job Description

A payroll director is a senior manager in an organization’s human resources department who is in charge of the organization’s payroll. This means taking care of the payroll process, making sure rules and policies are followed, and keeping accurate records.

Payroll Director Responsibilities

The Payroll Director has a wide range of responsibilities, including:

Payroll processing and management: The payroll director is in charge of the whole payroll process, which includes figuring out salaries, taxes, and benefits for employees and making sure they are paid on time and correctly.

Compliance with rules and policies: It is the payroll director’s job to make sure that federal, state, and local rules about payroll and the organization’s own rules and policies are followed.

Keeping accurate records and sending out reports: The payroll director is in charge of keeping accurate records of payroll and sending out reports that help with financial analysis and planning.

Payroll Director Requirements and Skills

To be a successful payroll director, you need to have specific qualifications and skills, including:

Educational qualifications: A bachelor’s degree in Accounting, Finance, Business Administration, or a related field is typically required for a Payroll Director role.

Professional certifications: Certifications like Certified Payroll Professional (CPP) or Fundamental Payroll Certification (FPC) are highly valued in the industry and can show how knowledgeable and skilled a candidate is in payroll management.

Skills required: The following skills are essential for a successful Payroll Director:

- Strong knowledge of payroll regulations and policies

- Ability to manage and supervise a team

- Attention to detail and accuracy

- Analytical and problem-solving skills

- Strong communication and interpersonal skills

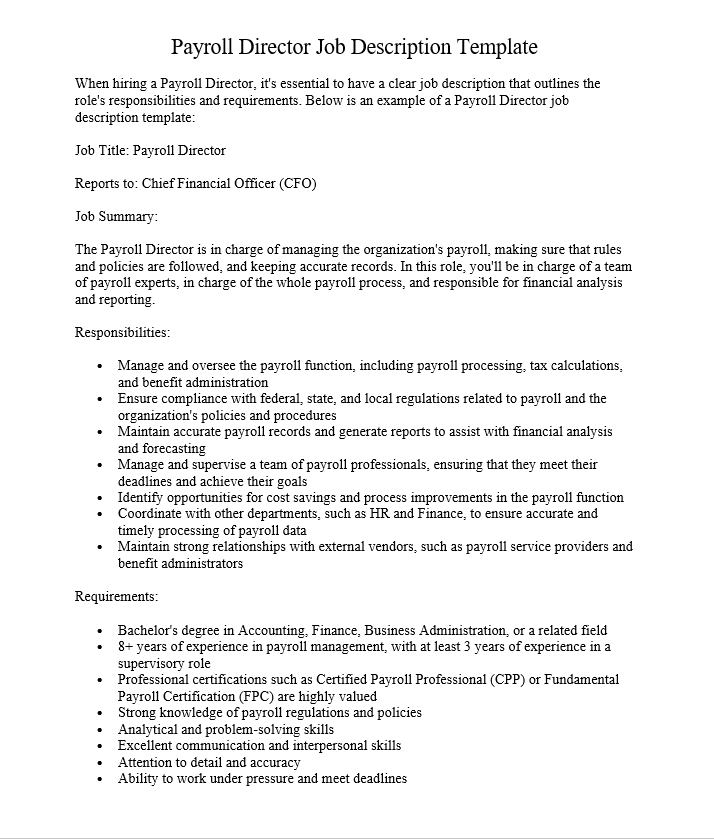

Payroll Director Job Description Template

When hiring a Payroll Director, it’s essential to have a clear job description that outlines the role’s responsibilities and requirements. Below is an example of a Payroll Director job description template:

Job Title: Payroll Director

Reports to: Chief Financial Officer (CFO)

Job Summary:

The Payroll Director is in charge of managing the organization’s payroll, making sure that rules and policies are followed, and keeping accurate records. In this role, you’ll be in charge of a team of payroll experts, in charge of the whole payroll process, and responsible for financial analysis and reporting.

Responsibilities:

- Manage and oversee the payroll function, including payroll processing, tax calculations, and benefit administration

- Ensure compliance with federal, state, and local regulations related to payroll and the organization’s policies and procedures

- Maintain accurate payroll records and generate reports to assist with financial analysis and forecasting

- Manage and supervise a team of payroll professionals, ensuring that they meet their deadlines and achieve their goals

- Identify opportunities for cost savings and process improvements in the payroll function

- Coordinate with other departments, such as HR and Finance, to ensure accurate and timely processing of payroll data

- Maintain strong relationships with external vendors, such as payroll service providers and benefit administrators

Requirements:

- Bachelor’s degree in Accounting, Finance, Business Administration, or a related field

- 8+ years of experience in payroll management, with at least 3 years of experience in a supervisory role

- Professional certifications such as Certified Payroll Professional (CPP) or Fundamental Payroll Certification (FPC) are highly valued

- Strong knowledge of payroll regulations and policies

- Analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Attention to detail and accuracy

- Ability to work under pressure and meet deadlines

-

What is the role of a Payroll Director?

A Payroll Director is responsible for managing the payroll function of an organization, ensuring compliance with regulations and policies, and maintaining accurate records. This means being in charge of the whole payroll process, figuring out salaries, taxes, and benefits for employees, and making sure they are paid correctly and on time.

-

What are the necessary qualifications for a Payroll Director?

To be a successful Payroll Director, you need to have a bachelor’s degree in Accounting, Finance, Business Administration, or a related field. Professional certifications like Certified Payroll Professional (CPP) or Fundamental Payroll Certification (FPC) are highly valued in the industry and can show how knowledgeable and skilled a candidate is in payroll management.

-

What skills are essential for a Payroll Director?

Strong knowledge of payroll regulations and policies, ability to manage and supervise a team, attention to detail and accuracy, analytical and problem-solving skills, and strong communication and interpersonal skills are all essential for a successful Payroll Director.

-

What are the responsibilities of a Payroll Director?

The Payroll Director is in charge of a lot of different things, like making sure all federal, state, and local rules about payroll are followed, keeping accurate payroll records and making reports to help with financial analysis and planning, and managing and supervising a team of payroll professionals.

-

What benefits does a Payroll Director bring to an organization?

A skilled and experienced Payroll Director can help ensure accurate and timely payment of employees, maintain compliance with regulations and policies, and identify opportunities for cost savings and process improvements. By effectively managing the payroll function, a Payroll Director can help maintain employee satisfaction and trust while also supporting the organization’s financial goals.

-

How does a Payroll Director work with other departments?

A Payroll Director works closely with other departments such as HR and Finance to ensure accurate and timely processing of payroll data. This collaboration is very important to make sure that employees are paid correctly and on time and that the organization stays in line with rules and regulations.

-

What are the challenges of being a Payroll Director?

The challenges of being a Payroll Director include keeping up with constantly changing regulations and policies related to payroll, managing a complex payroll process that involves multiple stakeholders, and ensuring accuracy and timeliness while working under pressure and tight deadlines.