Senior Accountant Job Description

The senior accountant’s job description can vary depending on the organization. However, the core duties typically include:

- Managing an organization’s financial records, including income statements, balance sheets, and cash flow statements.

- Preparing financial reports and presenting them to stakeholders.

- Analyzing financial data to identify trends and make recommendations to management.

- Managing the budget and ensuring financial targets are met.

- Overseeing the work of other accountants and finance staff.

- Ensuring compliance with financial regulations and laws.

- Developing financial policies and procedures.

Senior Accountant Responsibilities

As a senior accountant, you will have several responsibilities that contribute to the success of the organization. These responsibilities include:

Preparing Financial Statements

The senior accountant is in charge of making financial statements, such as balance sheets, income statements, and cash flow statements. These statements provide an overview of the organization’s financial performance.

Analyzing Financial Data

The senior accountant analyzes financial data to identify trends, make recommendations to management, and identify potential areas for improvement.

Managing the Budget

The senior accountant manages the organization’s budget and ensures that financial targets are met. This involves forecasting revenue and expenses and creating financial plans.

Overseeing Other Finance Staff

The senior accountant is in charge of making sure that other accountants and finance staff do their jobs well. This includes training and mentoring new employees, looking over their work, and making sure they are doing their jobs well.

Ensuring Compliance with Financial Regulations and Laws

The senior accountant ensures that the organization complies with financial regulations and laws. This includes tax laws, accounting standards, and other financial regulations.

Developing Financial Policies and Procedures

The senior accountant makes sure that the organization’s financial processes are efficient and effective by coming up with financial policies and procedures.

Senior Accountant Requirements and Skills

To become a senior accountant, you will need to meet the following requirements:

Educational and Professional Qualifications

For most senior accounting jobs, you need a bachelor’s degree in accounting, finance, or a related field. Professional qualifications, like Certified Public Accountant (CPA) or Certified Management Accountant (CMA) certification, are also a plus.

Work Experience

To become a senior accountant, you will typically need at least 5-7 years of relevant work experience in finance or accounting.

Technical Skills

The senior accountant must have advanced knowledge of accounting principles and practices. They should also be proficient in accounting software and Microsoft Excel.

Soft Skills

Excellent communication and interpersonal skills are essential for a senior accountant. For the role, you also need to pay attention to details and be accurate, have strong analytical and problem-solving skills, and be able to work under pressure and meet deadlines.

Senior Accountant Job Description Template Example

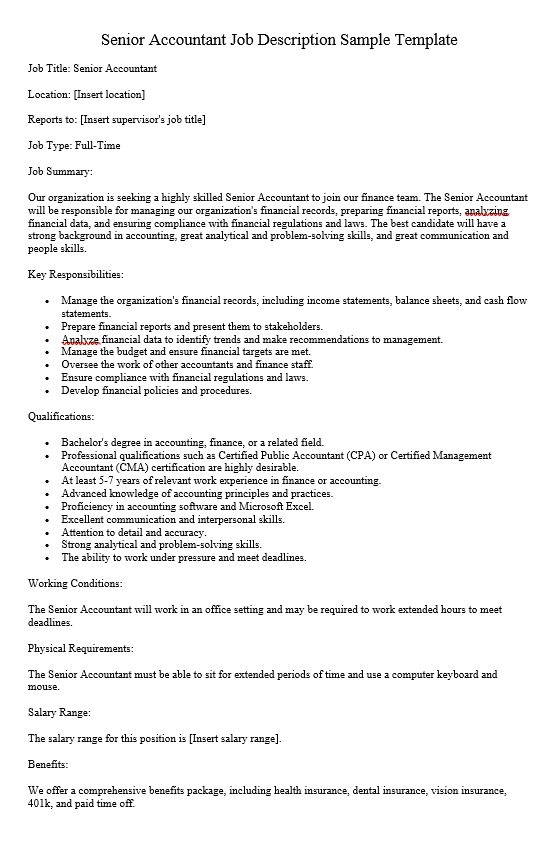

Job Title: Senior Accountant

Location: [Insert location]

Reports to: [Insert supervisor’s job title]

Job Type: Full-Time

Job Summary:

Our organization is seeking a highly skilled Senior Accountant to join our finance team. The Senior Accountant will be responsible for managing our organization’s financial records, preparing financial reports, analyzing financial data, and ensuring compliance with financial regulations and laws. The best candidate will have a strong background in accounting, great analytical and problem-solving skills, and great communication and people skills.

Key Responsibilities:

- Manage the organization’s financial records, including income statements, balance sheets, and cash flow statements.

- Prepare financial reports and present them to stakeholders.

- Analyze financial data to identify trends and make recommendations to management.

- Manage the budget and ensure financial targets are met.

- Oversee the work of other accountants and finance staff.

- Ensure compliance with financial regulations and laws.

- Develop financial policies and procedures.

Qualifications:

- Bachelor’s degree in accounting, finance, or a related field.

- Professional qualifications such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA) certification are highly desirable.

- At least 5-7 years of relevant work experience in finance or accounting.

- Advanced knowledge of accounting principles and practices.

- Proficiency in accounting software and Microsoft Excel.

- Excellent communication and interpersonal skills.

- Attention to detail and accuracy.

- Strong analytical and problem-solving skills.

- The ability to work under pressure and meet deadlines.

Working Conditions:

The Senior Accountant will work in an office setting and may be required to work extended hours to meet deadlines.

Physical Requirements:

The Senior Accountant must be able to sit for extended periods of time and use a computer keyboard and mouse.

Salary Range:

The salary range for this position is [Insert salary range].

Benefits:

We offer a comprehensive benefits package, including health insurance, dental insurance, vision insurance, 401k, and paid time off.

Q: What is a senior accountant?

A: A senior accountant is a finance professional responsible for managing the financial records of an organization, preparing financial reports, analyzing financial data, and ensuring compliance with financial regulations and laws.

Q: What are the key responsibilities of a senior accountant?

A: The key responsibilities of a senior accountant include managing the organization’s financial records, preparing financial reports, analyzing financial data, managing the budget, ensuring compliance with financial regulations and laws, overseeing the work of other accountants and finance staff, and developing financial policies and procedures.

Q: What qualifications are required to become a senior accountant?

A: To become a senior accountant, you typically need a bachelor’s degree in accounting, finance, or a related field. Professional qualifications like Certified Public Accountant (CPA) or Certified Management Accountant (CMA) certification are very desirable. At least 5-7 years of relevant work experience in finance or accounting is also typically required.

Q: What skills are important for a senior accountant to have?

A: A senior accountant needs advanced knowledge of accounting principles and practices, skill with accounting software and Microsoft Excel, good communication and people skills, attention to detail and accuracy, strong analytical and problem-solving skills, and the ability to work under pressure and meet deadlines.

Q: What is the working environment for a senior accountant?

A: A senior accountant typically works in an office setting and may be required to work extended hours to meet deadlines.

Q: What is the salary range for a senior accountant?

A: The salary range for a senior accountant varies depending on location, industry, and level of experience. However, according to Glassdoor, the national average salary for a senior accountant in the United States is $77,000 per year.

Q: What benefits do senior accountants typically receive?

A: Senior accountants typically receive a comprehensive benefits package, including health insurance, dental insurance, vision insurance, 401k, and paid time off.