Tax Associate Job Description

At its core, a tax associate’s job is to help clients comply with tax laws and regulations. This means preparing and reviewing tax returns, doing research and analysis on taxes, and giving clients advice on how to plan their taxes. Tax associates must also make sure that their clients follow all tax laws, whether they are federal, state, or local.

Tax Associate Responsibilities

The responsibilities of a tax associate are vast and varied. Some of the key responsibilities include:

- Preparing and reviewing tax returns for clients

- Conducting tax research and analysis

- Ensuring compliance with tax regulations

- Providing tax planning advice to clients

- Building and maintaining strong relationships with clients

- Staying up to date with changes in tax laws and regulations

Tax Associate Requirements and Skills

To become a tax associate, you’ll need a combination of education, certifications, technical skills, and soft skills. Here are some of the requirements and skills that you’ll need to succeed in this field:

Educational Background Requirements

Most tax associate positions require at least a bachelor’s degree in accounting or a related field. Some firms may also require a master’s degree or other advanced degree.

Certifications Needed

Certified Public Accountant (CPA) and Enrolled Agent (EA) are two of the most sought-after certifications for tax associates. These certifications demonstrate that you have the knowledge and skills needed to perform tax-related work at a high level.

Technical Skills Required

Tax associates need strong technical skills, like knowing tax laws and rules, being able to use tax preparation software well, and being able to think critically and solve problems.

Soft Skills Required

In addition to technical skills, tax associates must also possess strong soft skills. These include excellent communication skills, attention to detail, the ability to work well under pressure, and strong time management skills.

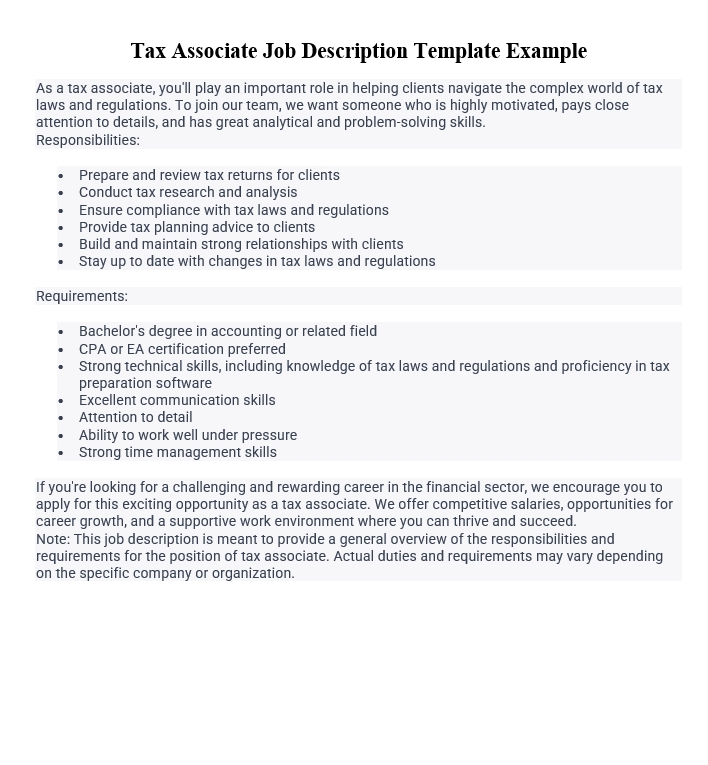

Tax Associate Job Description Template Example

As a tax associate, you’ll play an important role in helping clients navigate the complex world of tax laws and regulations. To join our team, we want someone who is highly motivated, pays close attention to details, and has great analytical and problem-solving skills.

Responsibilities:

- Prepare and review tax returns for clients

- Conduct tax research and analysis

- Ensure compliance with tax laws and regulations

- Provide tax planning advice to clients

- Build and maintain strong relationships with clients

- Stay up to date with changes in tax laws and regulations

Requirements:

- Bachelor’s degree in accounting or related field

- CPA or EA certification preferred

- Strong technical skills, including knowledge of tax laws and regulations and proficiency in tax preparation software

- Excellent communication skills

- Attention to detail

- Ability to work well under pressure

- Strong time management skills

If you’re looking for a challenging and rewarding career in the financial sector, we encourage you to apply for this exciting opportunity as a tax associate. We offer competitive salaries, opportunities for career growth, and a supportive work environment where you can thrive and succeed.

Note: This job description is meant to provide a general overview of the responsibilities and requirements for the position of tax associate. Actual duties and requirements may vary depending on the specific company or organization.

FAQs: Tax Associate Job

Q: What is a tax associate?

A: A tax associate is a professional who helps clients comply with tax laws and regulations by preparing and reviewing tax returns, conducting tax research and analysis, and providing tax planning advice.

Q: What are the responsibilities of a tax associate?

A: A tax associate’s job is to prepare and review tax returns, do tax research and analysis, make sure tax rules are followed, give tax planning advice to clients, build and keep strong relationships with clients, and stay up to date on changes in tax laws and regulations.

Q: What education is required to become a tax associate?

A: Most tax associate positions require at least a bachelor’s degree in accounting or a related field. Some firms may also require a master’s degree or other advanced degree.

Q: What certifications are required to become a tax associate?

A: Tax associates who have certifications like Certified Public Accountant (CPA) or Enrolled Agent (EA) are in high demand. These certifications demonstrate that you have the knowledge and skills needed to perform tax-related work at a high level.

Q: What technical skills are required to become a tax associate?

A: Tax associates need strong technical skills, including knowledge of tax laws and regulations, proficiency in tax preparation software, and strong analytical and problem-solving skills.

Q: What soft skills are required to become a tax associate?

A: In addition to technical skills, tax associates must also possess strong soft skills. These include excellent communication skills, attention to detail, the ability to work well under pressure, and strong time management skills.

Q: What is the job outlook for tax associates?

A: The demand for skilled tax professionals continues to grow, making it a promising field for those interested in pursuing a career as a tax associate. The Bureau of Labor Statistics predicts that the number of accountants and auditors, which includes tax associates, will grow by 6% between 2020 and 2030, which is faster than the average for all jobs.

Q: What is the salary range for tax associates?

A: The salary range for tax associates varies depending on factors such as experience, location, and company size. According to Glassdoor, the national average salary for tax associates in the United States is around $62,000 per year.

Q: What are the career growth opportunities for tax associates?

A: There are many career growth opportunities for tax associates, including moving up to higher-level tax positions such as tax manager or tax director. Tax associates can also move into fields like financial planning or corporate finance, which are related.