Tax Manager Job Description

As a tax manager, you will be in charge of making sure a company’s taxes are paid, planned for, and reported. You will also work closely with other departments to ensure that tax considerations are factored into any business decisions. The primary duties of a tax manager include:

Tax Planning and Compliance

- Developing and implementing tax strategies that align with a company’s goals and objectives.

- Ensuring that the company complies with all tax laws and regulations.

- Conducting tax research to stay up-to-date on new tax laws and regulations.

Management of Tax Returns and Reports

- Overseeing the preparation and filing of tax returns and reports.

- Reviewing tax returns and reports for accuracy.

- Responding to tax notices and audits.

Tax Analysis and Research

- Analyzing financial data to identify tax planning opportunities.

- Conducting tax research to resolve complex tax issues.

- Evaluating the tax implications of business decisions.

Coordination with Internal and External Stakeholders

- Collaborating with other departments to ensure that tax considerations are factored into business decisions.

- Working with external auditors and tax authorities to resolve tax issues.

Reporting and Communication

- Reporting on tax-related matters to senior management and other stakeholders.

- Communicating tax-related matters to employees.

Job Settings

Tax managers work in places like law firms, corporations, government agencies, and accounting firms.

Working Hours

The typical workweek for a tax manager is 40 hours. However, overtime may be required during tax season.

Tax Manager Responsibilities

As a tax manager, your responsibilities will include:

Tax Compliance

- Ensuring that the company complies with all tax laws and regulations.

- Staying up-to-date on changes to tax laws and regulations.

- Filing accurate tax returns and reports.

Tax Planning and Strategy

- Developing and implementing tax strategies that align with a company’s goals and objectives.

- Conducting tax research to stay up-to-date on new tax laws and regulations.

- Evaluating the tax implications of business decisions.

Financial Reporting

- Overseeing the preparation and filing of tax returns and reports.

- Reviewing financial data to identify tax planning opportunities.

- Ensuring that financial reporting complies with tax laws and regulations.

Staff Management and Training

- Managing tax staff.

- Providing training to tax staff.

- Conducting performance evaluations of tax staff.

Collaboration and Networking

- Collaborating with other departments to ensure that tax considerations are factored into business decisions.

- Networking with other tax professionals.

Tax Manager Requirements and Skills

To become a tax manager, you typically need:

Education

- Bachelor’s or master’s degree in accounting, finance, or a related field.

Certifications and Licenses

- Certified Public Accountant (CPA) license or equivalent.

- Other certifications, such as Certified Management Accountant (CMA), Chartered Financial Analyst (CFA), or Enrolled Agent (EA), may also be required or preferred.

Experience

- Several years of experience in tax compliance, planning, and reporting.

- Experience in related fields, such as accounting or finance, may also be beneficial.

Skills

- Strong analytical and problem-solving skills.

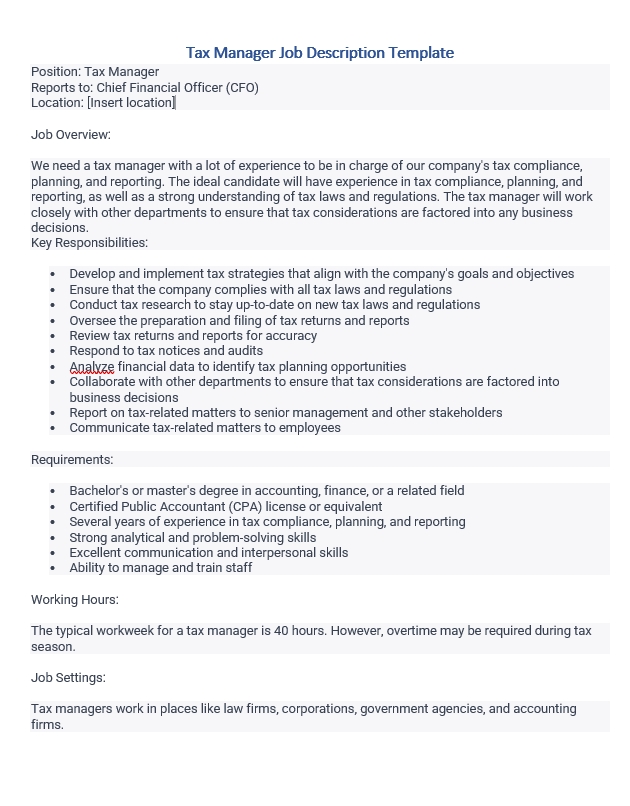

Tax Manager Job Description Template

Position: Tax Manager

Reports to: Chief Financial Officer (CFO)

Location: [Insert location]

Job Overview:

We need a tax manager with a lot of experience to be in charge of our company’s tax compliance, planning, and reporting. The ideal candidate will have experience in tax compliance, planning, and reporting, as well as a strong understanding of tax laws and regulations. The tax manager will work closely with other departments to ensure that tax considerations are factored into any business decisions.

Key Responsibilities:

- Develop and implement tax strategies that align with the company’s goals and objectives

- Ensure that the company complies with all tax laws and regulations

- Conduct tax research to stay up-to-date on new tax laws and regulations

- Oversee the preparation and filing of tax returns and reports

- Review tax returns and reports for accuracy

- Respond to tax notices and audits

- Analyze financial data to identify tax planning opportunities

- Collaborate with other departments to ensure that tax considerations are factored into business decisions

- Report on tax-related matters to senior management and other stakeholders

- Communicate tax-related matters to employees

Requirements:

- Bachelor’s or master’s degree in accounting, finance, or a related field

- Certified Public Accountant (CPA) license or equivalent

- Several years of experience in tax compliance, planning, and reporting

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Ability to manage and train staff

Working Hours:

The typical workweek for a tax manager is 40 hours. However, overtime may be required during tax season.

Job Settings:

Tax managers work in places like law firms, corporations, government agencies, and accounting firms.

FAQs – Tax Manager Job

Q: What is a tax manager?

A: A tax manager is in charge of making sure that an organization follows tax laws, plans for taxes, and reports on taxes. They ensure that the organization complies with tax laws and regulations while also identifying tax planning opportunities that can save the organization money.

Q: What are the responsibilities of a tax manager?

A: A tax manager’s duties include coming up with and implementing tax strategies, making sure taxes are done right, doing tax research, overseeing the preparation and filing of tax returns and reports, responding to tax notices and audits, analyzing financial data to find tax planning opportunities, working with other departments, and reporting on tax-related matters to senior management and other stakeholders.

Q: What qualifications are required for a tax manager?

A: Generally, a bachelor’s or master’s degree in accounting, finance, or a related field is required, along with a Certified Public Accountant (CPA) license or equivalent. Several years of experience in tax compliance, planning, and reporting is also typically required.

Q: What skills are necessary for a tax manager?

A: A tax manager must have strong analytical and problem-solving skills, great communication and people skills, and the ability to manage and train staff. In addition, a tax manager should have a strong understanding of tax laws and regulations and the ability to conduct tax research to stay up-to-date on new developments.

Q: What is the work environment like for a tax manager?

A: Tax managers work in a variety of settings, including accounting firms, law firms, corporations, and government agencies. The typical workweek for a tax manager is 40 hours, although overtime may be required during tax season.

Q: What is the salary range for a tax manager?

A: The salary range for a tax manager varies depending on factors such as location, industry, and experience level. According to PayScale, the average salary for a tax manager in the United States is $99,000 per year, with a range of $66,000 to $143,000 per year.