Tax Preparer Job Description

A tax preparer is a professional who helps people, businesses, and organizations fill out and file their tax returns. They are knowledgeable about tax laws and regulations and can help taxpayers file accurate tax returns. There are various types of tax preparers, including enrolled agents, certified public accountants (CPAs), and tax attorneys.

Role of Tax Preparer in Tax Preparation Process

The primary role of a tax preparer is to help clients navigate the complex tax preparation process and ensure that they comply with tax laws and regulations. They get their clients’ financial information, figure out how much tax they owe, and fill out their tax forms. Tax preparers also need to ensure that all tax credits and deductions are accurately applied, and that their clients’ tax liability is minimized.

Types of Tax Preparers

Enrolled Agents (EAs) are tax experts who have been given permission by the IRS to help taxpayers with tax issues. They have passed a full exam that covered both personal and business tax returns and are required to keep learning to keep their licenses.

Certified Public Accountants (CPAs) are licensed accountants who have passed the Uniform CPA Examination and met other state requirements. They can help with a wide range of financial services, such as preparing taxes, keeping track of money, and planning for the future.

Tax Attorneys are lawyers who specialize in tax law. They can help people and businesses with tax problems or disputes by giving them legal advice and representing them in court.

Tax Preparer Responsibilities

Tax preparers have various responsibilities, including:

Gathering Tax Information from Clients – Tax preparers are responsible for gathering all necessary financial information from clients to complete tax forms accurately. They have to look at the clients’ financial statements, receipts, and any other relevant documents to make sure they have everything they need to fill out the tax return.

Computing Tax Liability and Completing Tax Forms – Once the tax preparer has all the necessary information, they compute the client’s tax liability and complete the tax forms. They have to make sure that all tax credits and deductions are used correctly and that the client’s tax bill is kept as low as possible.

Ensuring Tax Law and Regulation Compliance – Tax preparers must ensure that their clients comply with all tax laws and regulations. They need to be aware of any changes to tax laws and ensure that their clients are aware of these changes.

Communicating with Clients and Government Agencies – Tax preparers need to communicate effectively with clients to ensure that they understand their tax obligations and that all necessary tax forms are filed on time. They may also need to communicate with government agencies on behalf of their clients to resolve any issues or disputes.

Tax Preparer Requirements and Skills

To become a tax preparer, you need to have:

Educational Requirements – Tax preparers are not required to have a college degree, but many employers prefer candidates with a degree in accounting, finance, or a related field.

Professional Certifications – There are various professional certifications that tax preparers can obtain, including Enrolled Agent (EA), Certified Public Accountant (CPA), and Registered Tax Return Preparer (RTRP).

Skills Needed for Tax Preparation – Tax preparers need to have strong analytical skills to review financial statements and other documents accurately. They must also have excellent communication and organizational skills to effectively communicate with clients

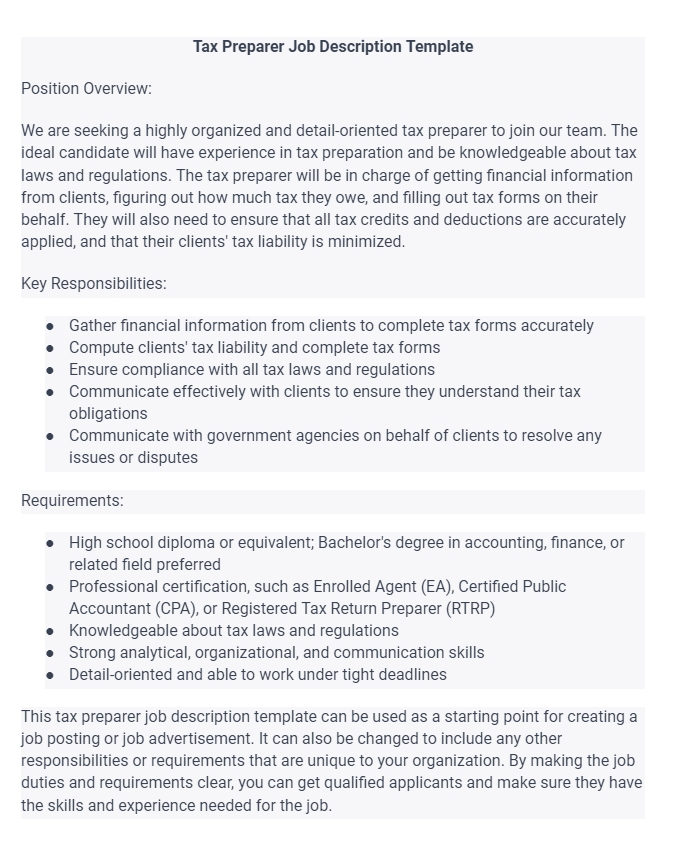

Tax Preparer Job Description Template

Position Overview:

We are seeking a highly organized and detail-oriented tax preparer to join our team. The ideal candidate will have experience in tax preparation and be knowledgeable about tax laws and regulations. The tax preparer will be in charge of getting financial information from clients, figuring out how much tax they owe, and filling out tax forms on their behalf. They will also need to ensure that all tax credits and deductions are accurately applied, and that their clients’ tax liability is minimized.

Key Responsibilities:

- Gather financial information from clients to complete tax forms accurately

- Compute clients’ tax liability and complete tax forms

- Ensure compliance with all tax laws and regulations

- Communicate effectively with clients to ensure they understand their tax obligations

- Communicate with government agencies on behalf of clients to resolve any issues or disputes

Requirements:

- High school diploma or equivalent; Bachelor’s degree in accounting, finance, or related field preferred

- Professional certification, such as Enrolled Agent (EA), Certified Public Accountant (CPA), or Registered Tax Return Preparer (RTRP)

- Knowledgeable about tax laws and regulations

- Strong analytical, organizational, and communication skills

- Detail-oriented and able to work under tight deadlines

This tax preparer job description template can be used as a starting point for creating a job posting or job advertisement. It can also be changed to include any other responsibilities or requirements that are unique to your organization. By making the job duties and requirements clear, you can get qualified applicants and make sure they have the skills and experience needed for the job.

FAQs About Tax Preparer Jobs

If you are considering a career as a tax preparer, you may have some questions about the job responsibilities, requirements, and qualifications. Here are some frequently asked questions and answers about tax preparer jobs:

Q: What is a tax preparer?

A: A tax preparer is a professional who assists clients with their tax obligations by gathering financial information, computing tax liability, and completing tax forms.

Q: What are the key responsibilities of a tax preparer?

A: A tax preparer’s main jobs are to get financial information from clients, figure out how much their taxes will be, fill out tax forms, make sure tax laws and rules are followed, and talk to clients and government agencies.

Q: What are the requirements for becoming a tax preparer?

A: The requirements for becoming a tax preparer vary depending on the state and organization. Tax preparers usually need a high school diploma or the equivalent, a professional certification like Enrolled Agent (EA), Certified Public Accountant (CPA), or Registered Tax Return Preparer (RTRP), and knowledge of tax laws and rules.

Q: What skills are necessary to become a successful tax preparer?

A: Successful tax preparers must have strong analytical, organizational, and communication skills. They should be detail-oriented, able to work under tight deadlines, and have a deep understanding of tax laws and regulations.

Q: What are the benefits of working as a tax preparer?

A: Tax preparers enjoy several benefits, including a flexible work schedule, the ability to work independently, and opportunities for career advancement. They also play a crucial role in helping clients meet their tax obligations and minimize their tax liability.

Q: How can I find tax preparer jobs?

A: You can work as a tax preparer in many places, such as accounting firms, tax preparation companies, and government agencies. You can search for tax preparer jobs on job boards, company websites, or by networking with other professionals in the field.