The Role and Responsibilities of a Treasurer Job Description: Requirements and Skills

A treasurer plays a crucial role in managing an organization’s finances. In this article, we’ll discuss the treasurer’s job description, responsibilities, and requirements, as well as the key skills needed for success in this role.

The treasurer’s job description involves managing the financial affairs of the organization. This includes keeping track of cash, making and managing budgets, forecasting and financial planning, keeping financial records, making sure financial rules are followed, and making recommendations to the board about money. The treasurer is also in charge of making sure that the finances are stable and growing by managing risks and investments.

Treasurer Responsibilities

The responsibilities of a treasurer can vary depending on the size and type of organization. However, some common responsibilities include:

- Managing the organization’s finances: The treasurer is responsible for managing the financial operations of the organization, ensuring that it has sufficient cash flow, and making sure that all financial transactions are recorded accurately.

- Creating and managing budgets: The treasurer creates budgets that allocate funds to different departments within the organization. They must monitor and adjust these budgets as necessary to ensure financial stability.

- Maintaining financial records: The treasurer must keep accurate financial records, including bank statements, invoices, and receipts. This ensures that the organization has a clear picture of its financial health.

- Ensuring compliance with financial regulations: The treasurer must ensure that the organization complies with all relevant financial regulations and laws. They must also prepare financial reports and submit them to regulatory bodies as required.

- Making financial recommendations to the board: The treasurer must analyze financial data and make recommendations to the board about investments, financial risks, and other financial matters.

Treasurer Requirements and Skills

Most of the time, you need a degree in finance or a related field to become a treasurer. Experience in financial management is also essential. Additionally, the treasurer must have the following skills:

- Strong analytical skills: The treasurer must be able to analyze complex financial data and use it to make strategic decisions.

- Attention to detail: Financial management requires a high level of attention to detail to ensure accuracy in financial records and reports.

- Excellent communication skills: The treasurer must be able to communicate financial information clearly to both financial and non-financial stakeholders.

- Knowledge of financial regulations and accounting principles: The treasurer must have a good understanding of financial regulations and accounting principles to ensure compliance with laws and regulations.

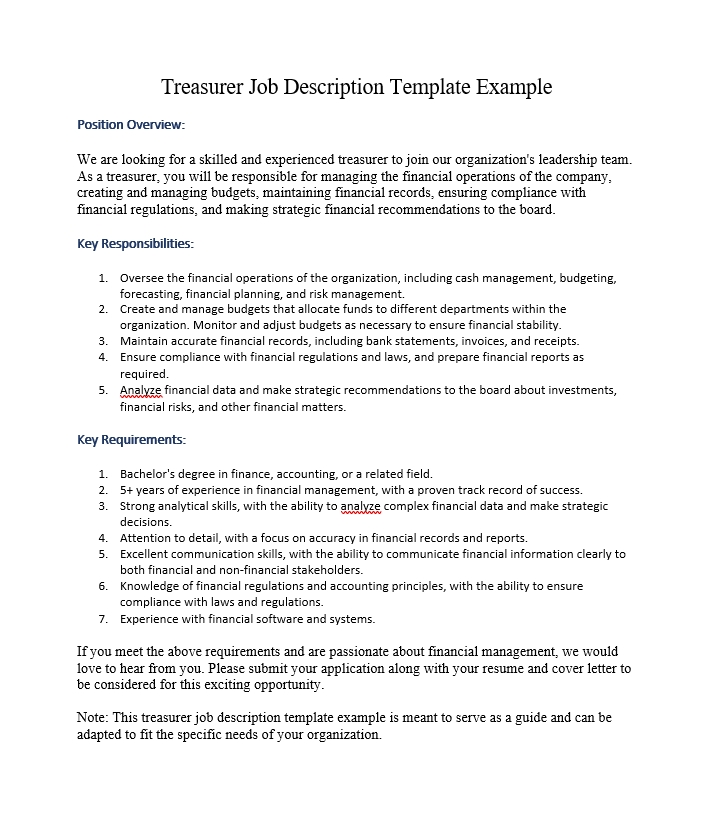

Treasurer Job Description Template Example

Position Overview:

We are looking for a skilled and experienced treasurer to join our organization’s leadership team. As a treasurer, you will be responsible for managing the financial operations of the company, creating and managing budgets, maintaining financial records, ensuring compliance with financial regulations, and making strategic financial recommendations to the board.

Key Responsibilities:

- Oversee the financial operations of the organization, including cash management, budgeting, forecasting, financial planning, and risk management.

- Create and manage budgets that allocate funds to different departments within the organization. Monitor and adjust budgets as necessary to ensure financial stability.

- Maintain accurate financial records, including bank statements, invoices, and receipts.

- Ensure compliance with financial regulations and laws, and prepare financial reports as required.

- Analyze financial data and make strategic recommendations to the board about investments, financial risks, and other financial matters.

Key Requirements:

- Bachelor’s degree in finance, accounting, or a related field.

- 5+ years of experience in financial management, with a proven track record of success.

- Strong analytical skills, with the ability to analyze complex financial data and make strategic decisions.

- Attention to detail, with a focus on accuracy in financial records and reports.

- Excellent communication skills, with the ability to communicate financial information clearly to both financial and non-financial stakeholders.

- Knowledge of financial regulations and accounting principles, with the ability to ensure compliance with laws and regulations.

- Experience with financial software and systems.

If you meet the above requirements and are passionate about financial management, we would love to hear from you. Please submit your application along with your resume and cover letter to be considered for this exciting opportunity.

Note: This treasurer job description template example is meant to serve as a guide and can be adapted to fit the specific needs of your organization.

Q: What are the key skills needed to succeed as a treasurer?

A: To be a good treasurer, you need to have strong analytical skills, pay close attention to details, have good communication skills, and know about financial rules and accounting principles.

Q: What are the benefits of having a treasurer in an organization?

A: Having a treasurer in an organization can help make sure it stays financially stable and grows. Treasurers make and manage budgets, keep accurate financial records, and give the board strategic financial advice.

Q: What are the challenges of being a treasurer?

A: Being a treasurer is hard because you have to manage financial risks, make sure you’re following complicated financial rules, and make hard financial decisions when you don’t know what will happen.

Q: What is the career path for a treasurer?

A: The career path for a treasurer usually involves starting as a financial analyst or accountant and working their way up through the ranks to become a treasurer or a CFO (Chief Financial Officer).

Q: What is the typical salary range for a treasurer?

A: The typical salary range for a treasurer can vary depending on the size and type of organization, as well as the treasurer’s level of experience and qualifications. According to Glassdoor, the average salary for a treasurer in the United States is around $123,000 per year.

Note: The above FAQ provides general information about treasurer’s job. Different organizations and job positions may have different requirements and responsibilities for a given job.