What Does a Treasury Analyst Do? Treasury Analyst Job Description, Responsibilities, and Description

The job description of a Treasury Analyst can vary depending on the organization, but there are several key components that are typically included. These components include financial analysis, cash management, investment management, risk management, and banking relationships.

- Financial Analysis: A Treasury Analyst’s job is to look at financial data and give management insights and suggestions. Financial Analysis: A Treasury Analyst’s job is to look at financial data and give management insights and suggestions. This includes analyzing cash flow, revenue and expenses, and investment returns.

- Cash Management: A Treasury Analyst’s job is to make sure the company has enough cash to pay its bills. This involves forecasting cash flow, managing cash balances, and processing payments.

- Investment Management: A Treasury Analyst’s job is to come up with and implement investment strategies that bring in the most money while taking the least amount of risk. This includes analyzing investment opportunities, selecting investments, and monitoring investment performance.

- Risk Management: A Treasury Analyst has to find and deal with any financial risks that could hurt the company. This includes making and using plans for risk management and keeping an eye on how exposed the organization is to financial risk.

- Relationships with banks: It is the job of a Treasury Analyst to manage relationships with banks and other financial institutions. This includes negotiating banking agreements, managing bank accounts, and ensuring compliance with banking regulations.

Treasury Analyst Responsibilities

There are three main types of tasks that a Treasury Analyst is responsible for daily operations, strategic planning, and reporting.

Daily Operations: It is the job of a Treasury Analyst to run the organization’s daily financial operations. This includes making cash flow forecasts, keeping track of cash balances, processing payments, and making sure policies and rules are followed.

Strategic Planning: A Treasury Analyst’s job is to come up with and implement financial plans that are in line with the goals of the organization. This includes developing investment strategies, risk management strategies, and maintaining banking relationships.

Reporting: A Treasury Analyst is responsible for preparing financial reports and analyzing financial data. This includes providing insights and recommendations to management based on their analysis.

Treasury Analyst Requirements and Skills

To do well as a Treasury Analyst, you need a mix of education, experience, technical skills, and “soft skills.”

Education and Experience Requirements: Most organizations require a Bachelor’s Degree in Finance or a related field, along with relevant work experience in finance or accounting.

Technical Skills: A Treasury Analyst must have strong technical skills, such as knowledge of financial modeling, skills in Microsoft Excel and other financial software, and familiarity with banking systems.

Soft Skills: A Treasury Analyst must have strong soft skills, including attention to detail, strong analytical and problem-solving skills, and the ability to work independently and as part of a team.

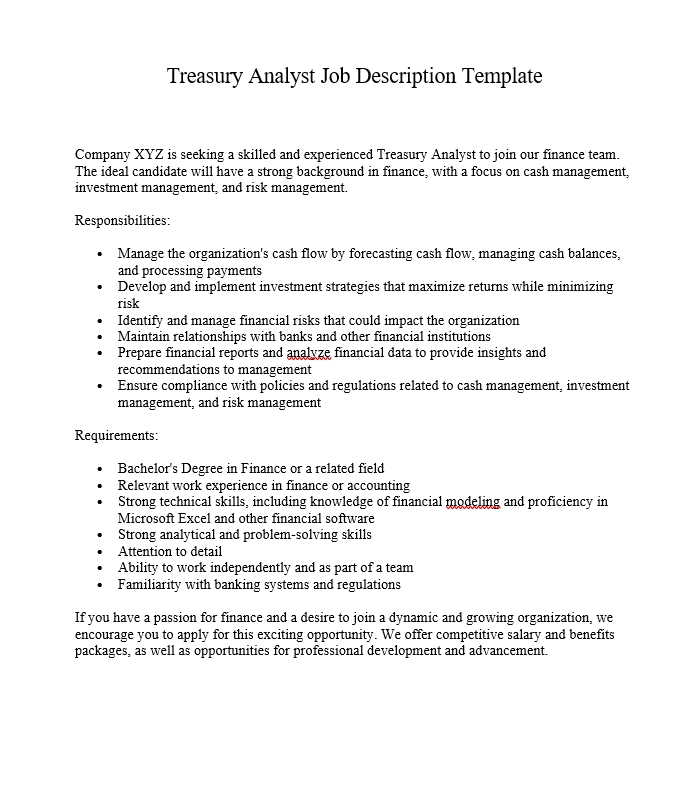

Treasury Analyst Job Description Template

Company XYZ is seeking a skilled and experienced Treasury Analyst to join our finance team. The ideal candidate will have a strong background in finance, with a focus on cash management, investment management, and risk management.

Responsibilities:

- Manage the organization’s cash flow by forecasting cash flow, managing cash balances, and processing payments

- Develop and implement investment strategies that maximize returns while minimizing risk

- Identify and manage financial risks that could impact the organization

- Maintain relationships with banks and other financial institutions

- Prepare financial reports and analyze financial data to provide insights and recommendations to management

- Ensure compliance with policies and regulations related to cash management, investment management, and risk management

Requirements:

- Bachelor’s Degree in Finance or a related field

- Relevant work experience in finance or accounting

- Strong technical skills, including knowledge of financial modeling and proficiency in Microsoft Excel and other financial software

- Strong analytical and problem-solving skills

- Attention to detail

- Ability to work independently and as part of a team

- Familiarity with banking systems and regulations

If you have a passion for finance and a desire to join a dynamic and growing organization, we encourage you to apply for this exciting opportunity. We offer competitive salary and benefits packages, as well as opportunities for professional development and advancement.

What is a Treasury Analyst?

A Treasury Analyst is a financial professional responsible for managing a company’s financial assets, cash management, and liquidity. They analyze financial data and market trends to make recommendations for investments and manage the company’s banking relationships.

What are the job responsibilities of a Treasury Analyst?

The job responsibilities of a Treasury Analyst include cash management, investment analysis, debt management, risk management, and financial reporting. They monitor and manage cash balances, assess investment options, manage the company’s debt, and analyze market trends to identify potential risks and opportunities.

What qualifications do I need to become a Treasury Analyst?

Typically, a Bachelor’s degree in finance, accounting, or a related field is required to become a Treasury Analyst. Some employers may prefer candidates with a Master’s degree or professional certification, such as the Certified Treasury Professional (CTP) designation. Relevant work experience is also highly valued by employers.

What skills are required for a Treasury Analyst job?

A Treasury Analyst should possess strong analytical, financial, and communication skills. They should be proficient in financial modeling, data analysis, and reporting. They should also have knowledge of financial regulations and be able to manage multiple tasks simultaneously.

What are the career prospects for a Treasury Analyst?

The career prospects for a Treasury Analyst are good, with job opportunities available in a variety of industries such as banking, finance, and corporate. The demand for Treasury Analysts is expected to increase in the coming years, with a projected growth rate of 5% from 2021 to 2031.

What is the salary range for a Treasury Analyst?

The salary range for a Treasury Analyst varies depending on the location, industry, and experience level. According to the Bureau of Labor Statistics, the median annual wage for financial analysts, which includes Treasury Analysts, was $83,660 in May 2020. However, salaries can range from $55,000 to over $140,000 per year.

Is experience necessary to become a Treasury Analyst?

While having relevant work experience is highly valued by employers, some companies may hire recent graduates or entry-level candidates for Treasury Analyst positions. However, it’s important to have a strong understanding of financial analysis and market trends to succeed in this role.